Years ended March 31

Total for Private-Sector Life Insurance Companies1

| ¥ billions | ||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

| Policy Amount in Force | ¥1,186,279.9 | ¥1,150,987.3 | ¥1,112,199.6 | ¥1,067,365.0 | ¥1,021,458.2 | ¥983,269.5 |

|---|---|---|---|---|---|---|

| Individual insurance | 1,112,170.5 | 1,070,570.8 | 1,026,336.0 | 979,437.4 | 932,971.8 | 890,603.9 |

| Individual annuities | 74,109.4 | 80,416.4 | 85,863.6 | 87,927.6 | 88,486.4 | 92,665.6 |

| New Policy Amount | 98,626.5 | 89,375.0 | 76,907.8 | 66,673.0 | 61,306.8 | 60,877.8 |

| Individual insurance | 91,159.2 | 80,753.4 | 67,991.9 | 58,649.5 | 53,992.7 | 53,390.8 |

| Individual annuities | ¥7,467.2 | ¥8,621.6 | ¥8,915.9 | ¥8,023.4 | ¥7,314.0 | ¥7,486.9 |

| ¥ billions | US$ billions | |||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | |

| Policy Amount in Force | ¥955,441.1 | ¥938,437.2 | ¥933,494.1 | ¥924,149.8 | ¥918,788.7 | $7,645.7 |

|---|---|---|---|---|---|---|

| Individual insurance | 861,954.2 | 842,303.3 | 833,170.6 | 823,805.0 | 818,273.5 | 6,809.2 |

| Individual annuities | 93,486.8 | 96,133.9 | 100,323.5 | 100,344.8 | 100,515.2 | 836.4 |

| New Policy Amount | 63,158.0 | 66,563.3 | 72,759.3 | 67,756.1 | 68,567.7 | 570.5 |

| Individual insurance | 57,087.2 | 59,386.1 | 64,829.8 | 60,276.9 | 60,428.8 | 502.8 |

| Individual annuities | ¥6,070.8 | ¥7,177.1 | ¥7,929.5 | ¥7,479.2 | ¥8,138.8 | $67.7 |

-

Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan.

The policy amount in force and the new policy amount are the simple sum of individual insurance and annuities. The new policy amount includes net increase from conversions. Figures do not include Japan Post Insurance. For convenience, U.S. dollar figures have been calculated at the rate of U.S.$1 = ¥120.17.

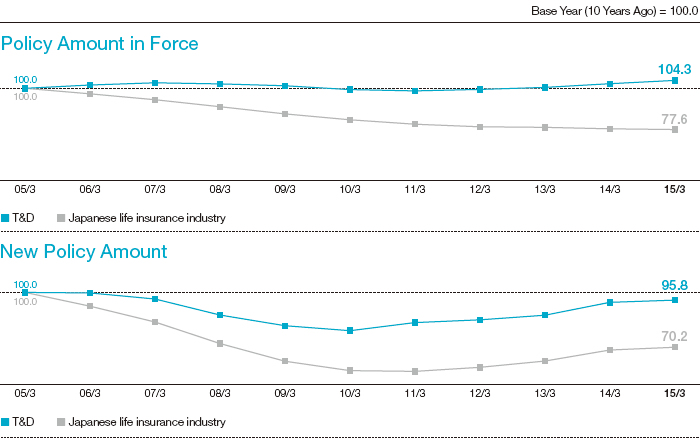

Trends in the Policy Amount in Force and New Policy Amount2

-

Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan.

Insurance premiums, new policy amount, and policy amount in force for the year ended March 31, 2005, are assumed to be 100.0 (base year).

The new policy amount includes net increase from conversions. Figures do not include Japan Post Insurance.

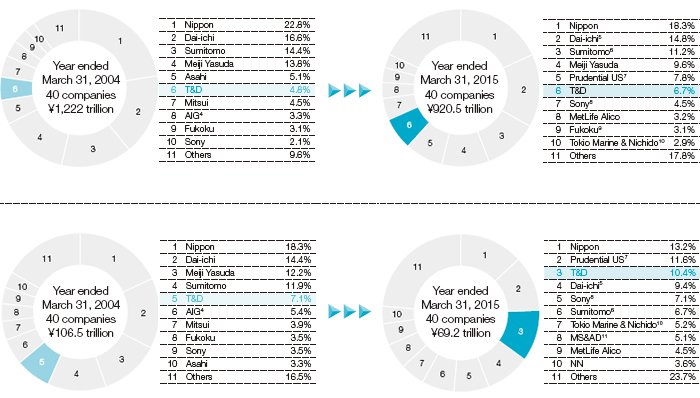

Trends in Market Share3

-

Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan.

The new policy amount and the policy amount in force are the sum of individual insurance and annuities and the insured amount of J-type product and T-type product. Figures do not include Japan Post Insurance. - AIG refers to Alico Japan, AIG Star and AIG Edison.

- Dai-ichi refers to Dai-ichi and Dai-ichi Frontier

- Sumitomo refers to Sumitomo and Medicare.

- Prudential US refers to Prudential, Gibraltar and Prudential Gibraltar Financial.

- Sony refers to Sony and AEGON Sony Life.

- Fukoku refers to Fukoku and Fukokushinrai.

- Tokio Marine & Nichido refers to Tokio Marine & Nichido Life and Tokio Marine & Nichido Financial.

- MS&AD refers to Mitsui Sumitomo Aioi and Mitsui Sumitomo Primary.