Years ended March 31

Total for Private-Sector Life Insurance Companies*1

| ¥ billions | ||||

| 2007 | 2008 | 2009 | 2010 | |

| Policy Amount in Force | ¥1,112,199.6 | ¥1,067,365.0 | ¥1,021,458.2 | ¥983,269.5 |

|---|---|---|---|---|

| Individual insurance | 1,026,336.0 | 979,437.4 | 932,971.8 | 890,603.9 |

| Individual annuities | 85,863.6 | 87,927.6 | 88,486.4 | 92,665.6 |

| New Policy Amount | 76,907.8 | 66,673.0 | 61,306.8 | 60,877.8 |

| Individual insurance | 67,991.9 | 58,649.5 | 53,992.7 | 53,390.8 |

| Individual annuities | 8,915.9 | 8,023.4 | 7,314.0 | 7,486.9 |

| ¥ billions | ||||

| 2011 | 2012 | 2013 | 2014 | |

| Policy Amount in Force | ¥955,441.1 | ¥938,437.2 | ¥933,494.1 | ¥924,149.8 |

|---|---|---|---|---|

| Individual insurance | 861,954.2 | 842,303.3 | 833,170.6 | 823,805.0 |

| Individual annuities | 93,486.8 | 96,133.9 | 100,323.5 | 100,344.8 |

| New Policy Amount | 63,158.0 | 66,563.3 | 72,759.3 | 67,756.1 |

| Individual insurance | 57,087.2 | 59,386.1 | 64,829.8 | 60,276.9 |

| Individual annuities | 6,070.8 | 7,177.1 | 7,929.5 | 7,479.2 |

| ¥ billions | US$ billions | |||

| 2015 | 2016 | 2016 | ||

| Policy Amount in Force | ¥918,788.7 | ¥914,316.5 | $8,114.2 | |

|---|---|---|---|---|

| Individual insurance | 818,273.5 | 814,197.8 | 7,225.7 | |

| Individual annuities | 100,515.2 | 100,118.7 | 888.5 | |

| New Policy Amount | 68,567.7 | 70,271.7 | 623.6 | |

| Individual insurance | 60,428.8 | 62,165.2 | 551.6 | |

| Individual annuities | 8,138.8 | 8,106.5 | 71.9 | |

- *1 Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan, and the financial reports of each company. The policy amount in force and the new policy amount are the simple sum of individual insurance and annuities. The new policy amount includes net increase from conversions. Figures do not include Japan Post Insurance.

For convenience, U.S. dollar figures have been calculated at the rate of U.S.$1=¥112.68.

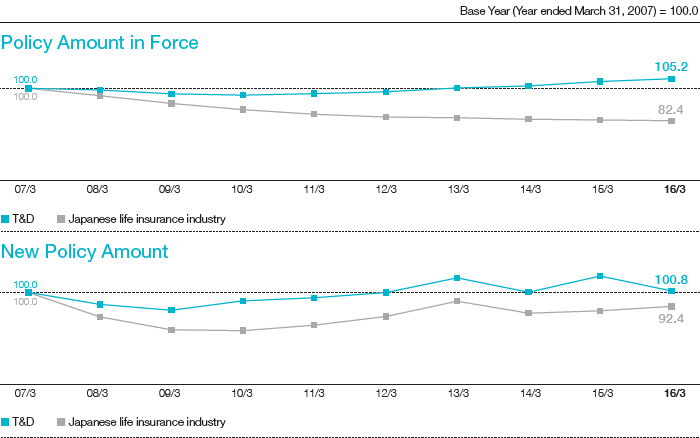

Trends in the Policy Amount in Force and New Policy Amount*2

- *2 Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan, and the financial reports of each company. Policy amount in force and new policy amount for the year ended March 31, 2007 are assumed to be 100.0 (base year). The new policy amount and the policy amount in force are the sum of individual insurance and annuities and the insured amount of J-type product, T-type product and Kaigo Relief of Daido Life. The new policy amount includes net increase from conversions. Figures do not include Japan Post Insurance.

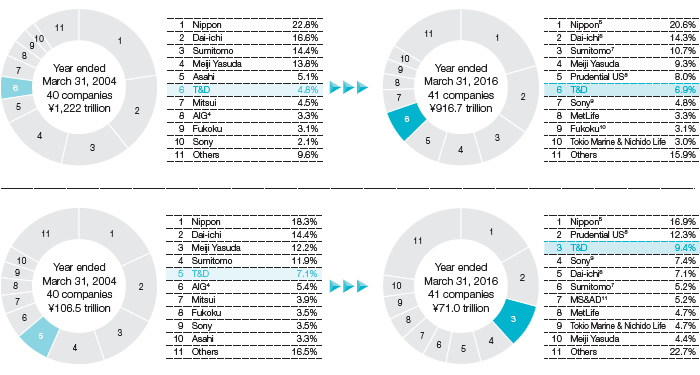

Trends in Market Share*3

- *3 Source: Compiled by T&D Holdings based on Summary of Life Insurance Business in Japan, Life Insurance Association of Japan, and the financial reports of each company. The policy amount in force and the new policy amount are the sum of individual insurance and annuities and the insured amount of J-type product, T-type product and Kaigo Relief of Daido Life. Figures do not include Japan Post Insurance.

- *4 AIG refers to Alico Japan, AIG Star and AIG Edison.

- *5 Nippon refers to Nippon and Mitsui.

- *6 Dai-ichi refers to Dai-ichi, Dai-ichi Frontier, and Neo First.

- *7 Sumitomo refers to Sumitomo and Medicare.

- *8 Prudential US refers to Prudential, Gibraltar and Prudential Gibraltar Financial.

- *9 Sony refers to Sony and AEGON Sony Life.

- *10 Fukoku refers to Fukoku and Fukokushinrai.

- *11 MS&AD refers to Mitsui Sumitomo Aioi and Mitsui Sumitomo Primary.