As a life insurance group, we give top priority to ensuring capital adequacy, while maintaining a capital efficiency above the level the Group should steadily keep.

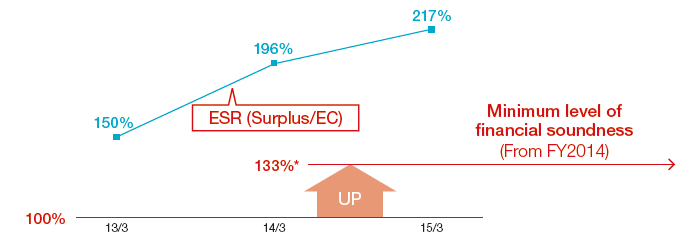

Capital Adequacy (ESR)

In regard to capital adequacy, the Economic Solvency Ratio (ESR) was 217% as of March 31, 2015, and the Group is maintaining sufficient financial soundness.

- * ESR 133% represents the capital level needed to cover VaR 99.93%, assuming the current risk profile.

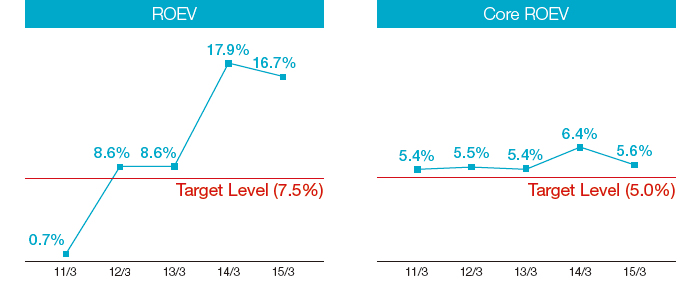

Capital Efficiency (ROEV, Core ROEV)

As for capital efficiency, we have set the target ROEV*1 level that we should steadily keep at 7.5% and above. We have set the target for Core ROEV*2, which has the value of new business as a critical factor, at 5.0% and above.

- In the fiscal year ended March 31, 2015, ROEV and Core ROEV stood at 16.7% and 5.6%, respectively, indicating that the Group has achieved a capital efficiency above its target levels.

- *1 Annual increase in EV (less capital movements) / Annual average of EV.

- *2 (Embedded value of new business + Expected existing business contribution from risk free rate) / Annual average of EV.