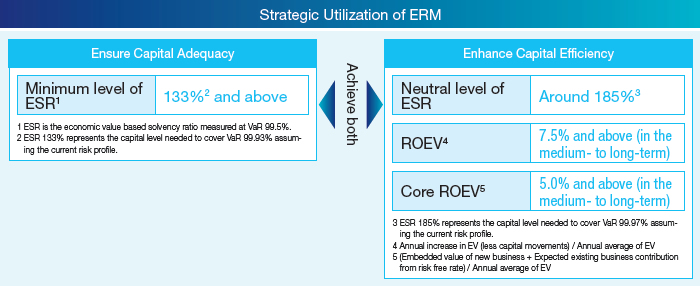

Group Capital Management Policy (Strategic Utilization of ERM)

Giving top priority to ensuring capital adequacy, the Group undertakes capital and risk management with the minimum level of the economic solvency ratio (ESR) set at 133% and above.

Moreover, the Group has set an ROEV of 7.5% and above and a core ROEV, which has the embedded value of new business as a critical factor, of 5.0% and above as its capital efficiency level targets for the medium- to long-term.

Under the current medium-term management plan, the Group will demonstrate a strategic awareness of risk and return by setting a neutral level of ESR as one of the Group's management indicators, in conjunction with steadily maintaining the required level while enhancing capital efficiency through proper risk-taking.

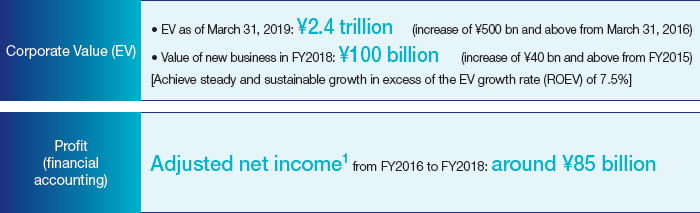

Key Performance Indicators

The Group has adopted corporate value (EV) and adjusted net income, which represents profit available for shareholder returns, as its key performance indicators, with the aim of achieving steady and sustainable growth in excess of the EV growth rate (ROEV) of 7.5%.

T&D Life Group's Consolidated Key Performance Indicators

- *1 Adjusted net income is calculated by adding net income and additional internal reserves in excess of the legal standard requirements related to reserves for contingency and price fluctuations (after taxes).

Shareholder Return Policy

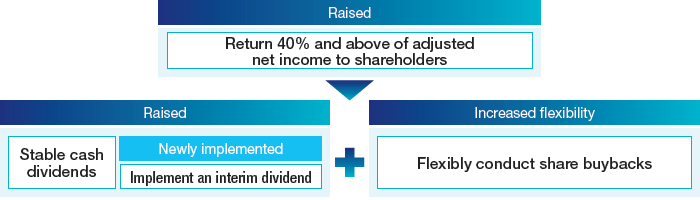

Under the current medium-term management plan, the Group has enhanced shareholder returns by revising its shareholder return policy.

During the current medium-term management plan, provided that capital adequacy is secured, the Group will increase the level of shareholder returns to 40% and above of adjusted net income, combining stable cash dividends and flexible share buybacks.

Highlights of Enhanced Shareholder Returns

- The level of shareholder returns was increased from “around 30% of adjusted net income over the medium and long terms” to “40% and above of adjusted net income” (applied ahead of schedule from fiscal 2015).

- Cash dividends were raised from ¥25 per share to ¥30 per share from fiscal 2015. Also, the Group will implement interim dividends from fiscal 2016.

- Increased the flexibility of share buybacks.