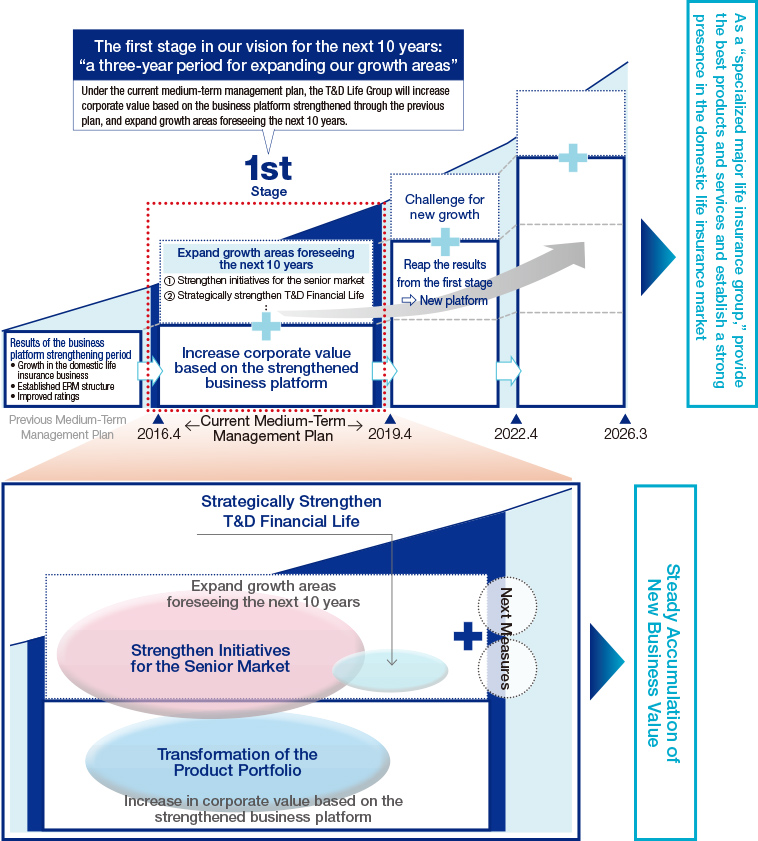

The T&D Life Group’s medium-term management plan for the three years, which started in April 2016, is positioned as “a three-year period for expanding our growth areas” and the first stage in a vision for the next 10 years.

Under a holding company structure, the T&D Life Group will steadily and sustainably increase its corporate value (EV) by maximizing the uniqueness and the specialization of the three core life insurance companies in their respective specialty markets.

Overview of Medium-Term Management Plan (April 2016–March 2019)

Overall Policies

- Positioning the domestic life insurance business as the core, the T&D Life Group will strengthen its initiatives in the senior market and the independent insurance agent channel with the goal of further expanding growth areas in addition to the established platform.

- Pursue alliance and M&A opportunities to strengthen competitiveness, expand market share, and improve profitability in the domestic life insurance market.

- Strategically utilize the ERM to promote effective use of stockholders’ equity and realize high profitability while ensuring financial soundness.

Strategy Points

Key Performance Indicators

The Group has adopted corporate value (EV) and adjusted net income, which represents profit available for shareholder return, as its key performance indicators, with the aim of achieving steady and sustainable growth in excess of the EV growth rate (ROEV) of 7.5%.

- * Adjusted net income is calculated by adding net income and additional internal reserves in excess of the legal standard requirements related to reserves for contingency and price fluctuations (after taxes).

Review of Fiscal 2016

In fiscal 2016, the first year of the medium-term management plan, the Group steadily executed its plans centered on the domestic life insurance business and achieved a significant increase in the value of new businesses and a solid increase in corporate value (EV), despite the continuation of low interest-rate environment. As result, the Group made steady progress towards the achievement of its plan in all key performance indicators—EV, value of new business, and adjusted new income.

- * Adjusted net income is calculated by adding net income and additional internal reserves in excess of the legal standard requirements related to reserves for contingency and price fluctuations (after taxes).

Initiatives for the Expansion of Shareholder Return

Under the current medium-term management plan, the Group has revised its shareholder return policy, and enhanced its shareholder return.

During the current medium-term management plan, provided that capital adequacy is secured, the Group will implement shareholder return of 40% and above of adjusted net income, combining stable cash dividends and flexible share buybacks.

- * The amount of “Share buybacks” is an approximate amount.

Domestic Life Insurance Business

The Group has laid out the strategy of “strengthen initiatives for the senior market” and “strategically strengthen T&D Financial Life,” with a view to expanding its presence in the independent insurance agent channel, in addition to the “transformation of the product portfolio” through the expansion into the Third Sector and into disability benefit insurance, which has been a priority measure since the previous medium-term management plan.

Domestic Life Insurance Business: Transformation of the Product Portfolio

Taiyo Life and Daido Life promoted initiatives focused on steadily accumulating death benefits. In addition to death benefit coverage, the Group also promoted transformation of the product portfolio to add the Third Sector and disability benefit insurance and suchlike as a response to the diversification of customer needs associated with the arrival of an aging society.

As a result, the percentage of Third Sector sales of the total of annualized premiums of new policies by the Group’s three life insurance companies rose from 10% in fiscal 2012 to 21% in fiscal 2016.

Trends in the percentage of the Third Sector in annualized premium of new policies (Five years: FY2012⇒FY2016)

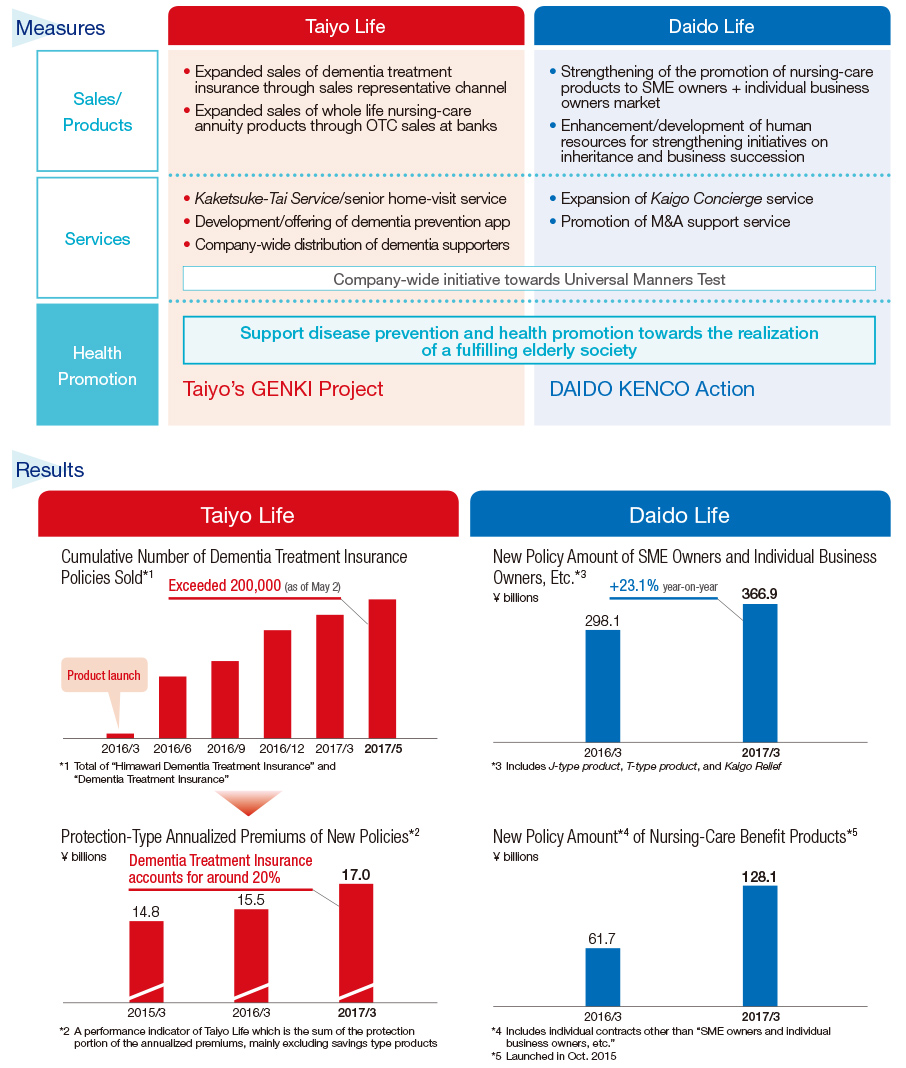

Domestic Life Insurance Business: Strengthen Initiatives for the Senior Market

Taiyo Life and Daido Life concentrated on “strengthening initiatives for the senior market” as an approach to expanding growth areas by promoting their distinctive products and services for their respective specialized markets. As a result, both companies achieved significant growth in their core products and key performance indicators.

Domestic Life Insurance Business: Strategically Strengthen T&D Financial Life

T&D Financial Life implemented various initiatives to increase the value of new business. As a result, it succeeded in turning the value back to positive in the fourth quarter, after it had trended negatively up to the third quarter due to the decline in domestic interest rates.

Results of Domestic Life Insurance Business

By promoting the domestic life insurance business centered on the “transformation of product portfolio” and the “strengthening initiatives for the senior market,” the sales of death benefits, the Third Sector and disability benefit insurance grew steadily and the value of new business increased favorably.

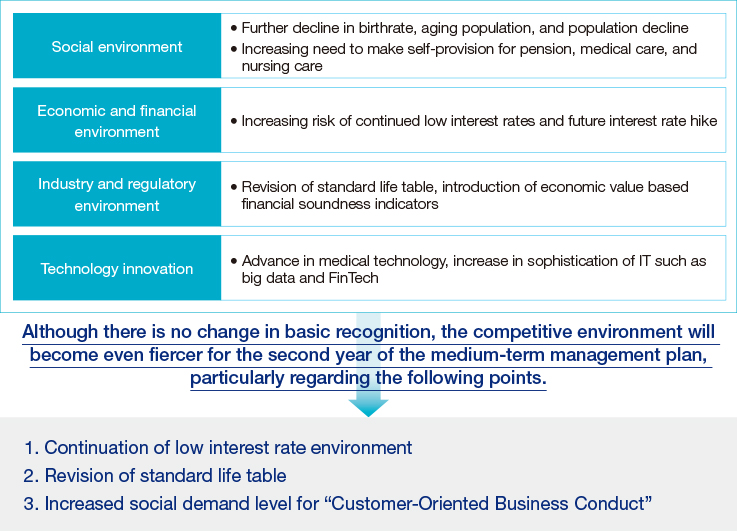

Confirmation of Environment Recognition for the Second Year of the Medium-Term Management Plan

Environment recognition for the next 10 years in the current medium-term management plan

Basic Policy for the Second Year of the Medium-Term Management Plan

- The Group is convinced that the medium-term management plan’s domestic life insurance business strategy leads to sustainable growth, based on the results of the first year of the plan

- For the second year of the plan, continue promoting sales enhancement of protectiontype products and strengthen initiatives for the senior market

- Further promote Group-wide effort to enhance the revenue base of T&D Financial Life

- In addition, focus on measures to expand new growth areas of the domestic life insurance business, and on pursuing opportunities for external growth