ERM (Enterprise Risk Management) is a strategic management method used to achieve managerial goals such as raising corporate value and maximizing earnings, through the integrated management of profit, risk and capital.

Under ERM, risk is not simply to be eliminated and reduced; but actively selected and assumed, giving consideration also to returns, namely, earnings.

The T&D Life Group has organized the Group ERM Committee to conduct ERM on a Groupwide basis. The committee leads efforts to promote ERM throughout the Group, aiming to improve its soundness while achieving stable and sustainable increases in corporate value.

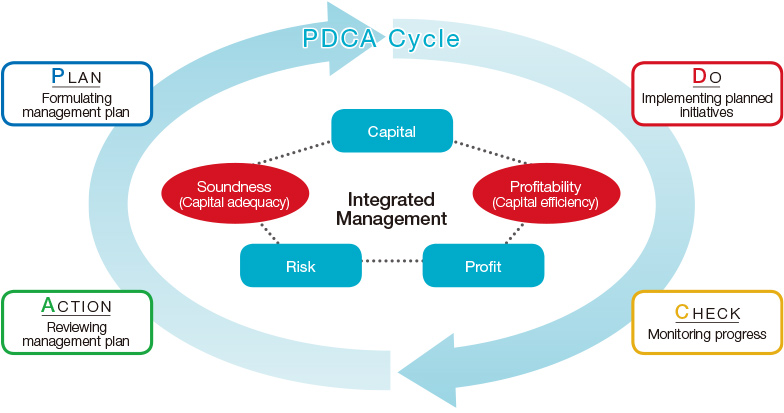

Specifically, we evaluated our profits, risk, and capital in economic value basis and set standards for soundness and profitability, which represent the Group Risk Appetite. Then, we promote ERM through the “PDCA Cycle” of formulating a management plan which meets the Group Risk Appetite (Plan), implementing the planned initiatives (Do), monitoring the progress of implementation of the plan (Check), and reviewing the plan as necessary (Action).

ROEV

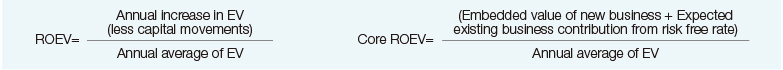

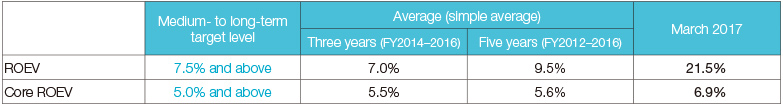

Typically, “ROE (Return on Equity)” is used as an indicator of capital efficiency, but considering the specificities of the life insurance accounting, the Company uses “ROEV (Return on Embedded Value),” which is calculated using EV.

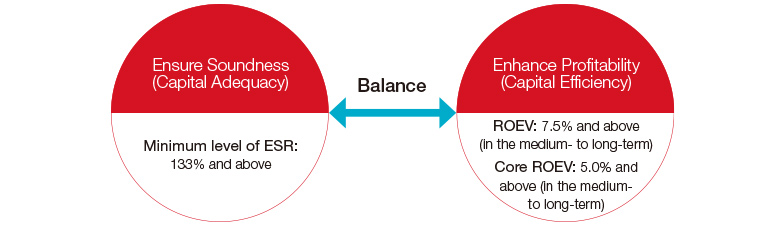

The Company has set an ROEV of 7.5% and above and a core ROEV, centered on the increase in EV according to new business acquisition, of 5.0% and above as medium- to longterm targets in our Group Risk Appetite.

ESR

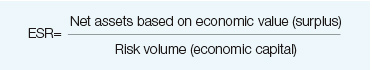

The Group has introduced ESR (Economic Solvency Ratio) as a financial soundness indicator based on economic value, and by controlling ESR within a set range, the Group works to maintain financial soundness and capital adequacy.

ESR is calculated by dividing net assets based on economic value (surplus) *1, evaluated using the same assumptions as for EV by the risk volume quantified using our internal model (economic capital) *2.

The minimum level of ESR of 133% in the Group Risk Appetite represents the capital level needed to cover VaR 99.93%.

- *1 The difference between assets and liabilities evaluated based on economic value. The evaluation of both assets and liabilities is calculated basically based on the same assumptions as MCEV. The cost of capital for risk margin has been set at 5% from the end of March 2017. It has been set referring to the Insurance Capital Standard (ICS) which the International Association of Insurance Supervisors (IAIS) is considering. The cost of capital for risk margin had been set at 6% on and before the end of March 2016.

- *2 Risk volume represents the economic value based risk volume, calculated using an internal model (99.5% VaR, 1-year) after diversification effects. Required capital for MCEV is calculated using the same internal model.