Basic Approach to Corporate Governance

The Company aims to achieve sustained growth and improvement of corporate value over the medium- to long-term by continuing to strengthen corporate governance, as described below.

- The Company shall respect the rights of shareholders and strive to develop a conducive environment for shareholders to appropriately exercise those rights. Efforts shall also be made to ensure the effective equality of all shareholders.

- The Company shall strive to foster a sound corporate culture and work environment by appropriately collaborating with a variety of stakeholders, including customers, shareholders, employees, insurance agents, business partners and local communities.

- The Company shall strive to increase the transparency of management through appropriate and timely disclosure of corporate information, including financial information and non-financial information regarding management strategies, management priorities and other matters.

- The Company shall strive to ensure the effectiveness of the Board of Directors' oversight function over the execution of business as the holding company responsible for the business execution management function of each Group company.

- The Company shall engage in constructive dialogue with stakeholders in order to contribute to sustainable growth and the enhancement of corporate value over the medium- to long-term.

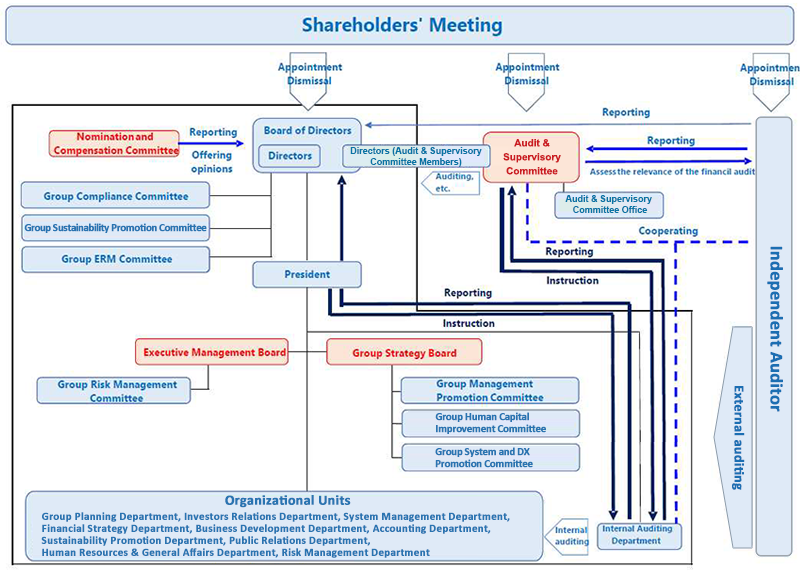

Corporate Governance System

The Company makes decisions on important business matters and oversees the execution of business through its Board of Directors. At the same time, the Company, as a company with an Audit & Supervisory Committee, audits and oversees the performance of directors’ duties among others through its Audit & Supervisory Committee, which is independent of the Board of Directors.

In addition, the Company has introduced an executive officer system for the purpose of bolstering its business execution capabilities. By clearly delineating responsibilities for oversight and execution, the Company strengthens the governance function of the Board of Directors.

The Company has also established a Nomination and Compensation Committee as an advisory body to the Board of Directors. The Committee deliberates on the fairness and appropriateness of the appointment, dismissal, succession planning, and compensation of directors and executive officers, thereby strengthening the corporate governance framework of T&D Holdings and the Group by ensuring the transparency of management and enhancing accountability.

Furthermore, the Group has put in place an Executive Committee as a body to discuss and resolve important matters concerning the business of the Company and the management of businesses of the Group. Along with this body is a Group Management Committee which was established by the Company as a body to deliberate matters concerning the Group’s growth strategies, etc. and related important matters from a Group-wide perspective to sustainably enhance the corporate value of the Group.

Promoting Group Management

The Company, as a holding company, fulfills the roles of deciding on the Group's strategy, appropriately allocating the Group's business resources and formulating capital strategies. Along with this, the Company strives to establish a Group business management system through such means as rigorously enforcing Group-wide risk-return management by accurately grasping the business risks borne by its nine directly owned subsidiaries centered on Taiyo Life, Daido Life, and T&D Financial Life, together with T&D United Capital, T&D Asset Management, Pet & Family Insurance, All Right, T&D Information System and T&D Investment Management North America. Furthermore, in April 2024, the Company introduced the Group Executive Officer System, under which the presidents of its direct subsidiaries concurrently serve as officers of the Company. This system enables each president to manage their respective company from a Group-wide optimization perspective, with the aim of enhancing the overall corporate value of the Group. In addition, this system promotes various measures aimed at the efficient utilization of Group management resources in an organic and integrated manner. The directly owned subsidiaries, with their own unique business strategies, aim to expand the Group's corporate value by maximizing their uniqueness and specialization through determining marketing strategies and operating businesses in line with their strengths.

The roles of the holding company and the directly owned subsidiaries are shown in the chart below.

By clarifying the respective roles and authorities of the Company and its directly owned subsidiaries, the Group is promoting group management characterized by flexibility and cohesiveness.

| Roles of Holding Company | Roles of Direct Subsidiaries |

|---|---|

|

|

|

|

Basic Policy on Corporate Governance

The Company has established the Basic Policy on Corporate Governance as a basic approach to corporate governance, intended to pursue T&D Insurance Group’s sustainable growth and improvement of corporate value in the mid-to long-term.

Basic Policy on Corporate Governance(PDF:251KB / 18 pages)

Corporate Governance Report

"Corporate Governance Report" submitted to the stock exchange is posted.

Corporate Governance Report(PDF:1.21MB / 23 pages)

Roles and Responsibilities of the Board of Directors, etc.

Roles of the Board of Directors

The Board of Directors shall make decisions on important business matters and oversee the execution of business in accordance with laws and ordinances, the Articles of Incorporation, and the Company’s relevant rules.

Owing to our transition to a company with an Audit & Supervisory Committee and in accordance with the provisions of the Articles of Incorporation, decisions on some important business executions are delegated from the Board of Directors to the directors themselves pursuant to a resolution of the Board of Directors. This separates management oversight from business execution, thereby further strengthening the management functions (deciding on management policies and overall strategy) and oversight functions of the Board of Directors. It also drives improvement in the flexibility and efficiency of business execution.

Composition of the Board of Directors

The number of directors (excluding directors who are Audit & Supervisory Committee members) of the Company shall be no more than nine and the number of directors who are Audit & Supervisory Committee members shall be no more than five, as stipulated by the Articles of Incorporation. The Board of Directors is made up of individuals representing a balance of knowledge, experience, and skills, and having diverse backgrounds in terms of gender, age, and international perspectives as befitting the expansive range of business domains in the life insurance business which is the core business of the Group. Moreover, the Company appoints two or more directors (excluding directors who are Audit & Supervisory Committee members) who concurrently serve at the Company and its directly owned subsidiaries as directors. This shall be done from the standpoint of facilitating adequate communication and rapid decision-making within the Group, along with bolstering Group-wide governance. Furthermore, the Company appoints outside directors to constitute more than one-third of directors, in order to appropriately reflect the opinions of individuals with extensive experience and knowledge in their capacity as outside corporate managers, legal experts, accounting specialists and so forth in the Group’s management policies and development of internal controls and other systems as well as in the oversight of the execution of business.

Roles of the Audit & Supervisory Committee

The Audit & Supervisory Committee of the Company carries out its roles and responsibilities by auditing the performance of duties by directors and attending to other matters as an independent function mandated by shareholders, based on laws and ordinances, the Articles of Incorporation and the Company’s relevant rules.

Composition of the Audit & Supervisory Committee

The number of members of the Audit & Supervisory Committee shall be no more than five as stipulated by the Articles of Incorporation. No less than half of Audit & Supervisory Committee members shall be outside members. The Audit & Supervisory Committee members shall include individuals who possess appropriate knowledge of finance and accounting. The Audit & Supervisory Committee shall consist of all of Audit & Supervisory Committee members.

Information Related to the Board of Directors and Audit & Supervisory Committee (Fiscal 2024)

| Number of meetings | Attendance rate | Main members and attendees | |

|---|---|---|---|

| Board of Directors | 19 | 98.1% | Directors |

| Audit & Supervisory Committee | 17 | 100.0% | Audit & Supervisory Committee members |

Attendance of outside directors to the meetings of the Board of Directors and the Audit & Supervisory Committee (Fiscal 2024)

| Name | Attendance | ||

|---|---|---|---|

| Board of Directors | Audit & Supervisory Committee | ||

| Outside directors | KENSAKU WATANABE | Attended all 19 meetings | ― |

| MASAZUMI KATO | Attended all 16 meetings | ― | |

| KENJI FUMA | Attended all 16 meetings | ― | |

| Outside Audit & Supervisory Committee members | SHINNOSUKE YAMADA | Attended all 19 meetings | Attended all 17 meetings |

| ATSUKO TAISHIDO | Attended 16 out of 19 meetings | Attended all 17 meetings | |

| KOJI NITTO | Attended all 16 meetings | Attended all 11 meetings | |

Appointment of Directors

The Board of Directors shall discuss the appointment of candidates for directors in the Nomination and Compensation Committee, and shall appoint individuals that satisfy, in principle, the following criteria:

- The candidate possesses the knowledge and experience needed to accurately, impartially and efficiently manage business as well as possessing a sufficient degree of public trust.

- In addition to the requirements set forth in the previous criterion, candidates for outside director must satisfy the independence criteria established by the Company and the Tokyo Stock Exchange, and must be recognized as being free from the risk of any conflicts with the common interests of shareholders.

Performance Review of Board of Directors

In order to ensure the overall effectiveness of the Board of Directors, the Board of Directors shall conduct an annual performance review of the Board of Directors as a whole, based on the self-evaluations of individual directors. The performance review shall examine whether or not the Board of Directors is functioning appropriately and producing results, and how the Board of Directors is contributing to increasing the Company's corporate value over the medium and long term.

Independence Criteria for Independent Outside Directors and Audit & Supervisory Committee Members.

The Company shall appoint candidates for outside director from among individuals who satisfy the following independence criteria:

- (1)The candidate is not currently, nor has been in the past 10 years, a person who executes the business of the Company or its subsidiaries.(2)The candidate is not currently, nor has recently been, a person/entity for which the Company is a major client or a person who executes business for such client, nor a major client of the Company or a person who executes business for such client.(3)The candidate is not currently, nor has recently been, a consultant, accounting expert, or legal expert who receives large amounts of cash or other assets in addition to director/auditor compensation from the Company.(4)The candidate is not currently, nor has recently been, a relative of a person who executes business of the Company or its subsidiary, or a relative of persons described in (2) or (3) above.(5)In addition to the above, there must be no doubt about the independence of the candidate in terms of fulfilling his or her duties as an independent outside director or Audit & Supervisory Committee member.

Policies on Determining the Amount of Compensation for Directors and Audit & Supervisory Committee Members and the Method of Calculating the Amount

The policies on determining the amount of compensation for the Company’s directors and Audit & Supervisory Committee Members and the method of calculating the amount shall be as follows.

- The policies on determining the amount of compensation for the Company’s directors and Audit & Supervisory Committee and the method of calculating the amount shall be as follows:

- (1)The compensation system, amount of compensation, etc., for the directors and Audit & Supervisory Committee Members shall be designed to function as a sound incentive to improve the Group’s performance and increase corporate value over the medium and long term.(2)The compensation system for the directors and Audit & Supervisory Committee Members shall comprise monthly compensation and bonuses, as well as trust-type stock compensation (not applicable to non-residents of Japan) using a trust system to grant the Company’s stock, etc. For compensation for directors who are not Audit & Supervisory Committee Members, the Board of Directors shall set the amount of compensation at an appropriate payment ratio for each type of compensation and according to the responsibilities of each position.(3)Cash shall be paid monthly for monthly compensation and annually for bonuses. In regard to trust-type stock compensation, stock and cash will be delivered and paid at the time of resignation based on the accumulated points granted. In cases where it is judged that any director has conducted any wrongdoing stipulated by the Company (serious delinquency, illegal conduct, data breach, etc.) before the date that the stock ownership rights are fixed, delivery and payment of stock and cash shall not be carried out. In addition, in cases where any wrongdoing is found after the date that the stock ownership rights are fixed, the Company may request compensation in the amount of the number of shares multiplied by the calculated stock price.

- Compensation for directors who are not Audit & Supervisory Committee Members (excluding part-time directors, including outside directors) shall be as follows:

- (1)The compensation system shall comprise monthly compensation and bonuses, as well as trust-type stock compensation (not applicable to non-residents of Japan) using a trust system to grant the Company’s stocks, etc., of which monthly compensation and bonuses shall vary based on performance, etc.(2)The Board of Directors shall determine the monthly compensation and bonuses of each director upon receiving a report on opinions from discussion by the Nomination and Compensation Committee and based on the report. The monthly compensation and bonuses shall be paid within the annual compensation limit established by resolution of the Shareholders’ Meeting and shall be based on figures calculated in accordance with the compensation table determined by the Board of Directors and a review of individual performance. In regard to trust-type stock compensation, in principle, points will be given annually to directors according to their ranks within the annual compensation limit established by resolution of the Shareholders’ Meeting.(3)The review of individual performance shall be determined by the Board of Directors upon receiving a report on opinions from discussion by the Nomination and Compensation Committee and based on the report. It shall be in accordance with the review standard determined by the Board of Directors and conducted based on the review of the Company’s business performance and the review of the director’s assigned division.(4)Multiple performance indicators, etc., established based on medium to long term management strategies, shall be used to review the Company’s business performance in the previous criterion. In regard to performance indicators, etc., scores shall be calculated by multiplying factors that are in accordance with the achievement level of each item.(5)In regard to the review of the director’s assigned division in (3) above, scores shall be calculated taking into account each division’s achievement level of the management plans.(6)The scores for the review of the Company’s business performance and the review of the director’s assigned division shall be the weighted average based on the performance review ratio stipulated in accordance with the responsibilities of each position. Note that the ratio of the review of the Company’s performance to the performance review of the representative director, etc., shall be 100%.

- Compensation for part-time directors, including outside directors, who are not Audit & Supervisory Committee Members shall be as follows:

- (1)The compensation system shall comprise only monthly (fixed) compensation.(2)The Board of Directors shall determine the monthly compensation of each director. The monthly compensation shall be paid within the annual compensation limit established by resolution of the Shareholders’ Meeting and shall be based on figures calculated in accordance with the compensation table determined by the Board of Directors.

- Compensation for directors who are Audit & Supervisory Committee Members shall be as follows:

- (1)The compensation system shall comprise only monthly (fixed) compensation.(2)Monthly compensation for each director shall be determined through discussions by the directors who are Audit & Supervisory Committee Members, within the annual compensation limit established by resolution of the Shareholders’ Meeting.

Ensuring Shareholder Rights and Equality, and Engaging in Dialogue with Shareholders and Other Stakeholders

Ensuring Shareholder Rights and Equality

The Company shall work to develop a conducive environment for shareholders to appropriately exercise their rights in order to effectively ensure the rights and the equality of all shareholders.

Shareholders' Meeting

Recognizing that the Shareholders' Meeting is the highest decision-making body of the Company, and that it provides a crucial forum for engaging in constructive dialogue with shareholders, the Company shall strive to develop an adequate environment from the shareholders' perspective to ensure that shareholders' views are reflected appropriately in management.

Dialogue with Shareholders and Other Stakeholders

The Company's organizational development and policies regarding the initiative to promote dialogue with shareholders and other stakeholders are as follows:

- The Company shall emphasize constructive dialogue with shareholders and other stakeholders as it strives to increase their understanding of its management policies through dialogue. At the same time, information and other feedback obtained through this dialogue shall be reported regularly to management. In this way, the Company shall strive to drive the sustained growth of the Group as a whole and increase its corporate value over the medium and long term.

- To engage in dialogue with shareholders and other stakeholders, the Company shall nominate the executive officer in charge of the Investor Relations Department as the Investor Relations (IR) and Shareholder Relations (SR) Officer.

- In providing information about the business environment, business strategies and financial conditions, and operating performance of the Group as a whole, in addition to statutory disclosures, the Company shall strive to enhance the disclosure of information by conducting IR and SR activities and providing audio and video streaming, along with making other content available via its corporate website.

- When disclosing the information described in Item 3. above, the Company shall strive to enhance the disclosed information by encouraging close coordination between various related departments, such as the IR and SR departments, and various Group companies.

- In order to prevent the unauthorized disclosure of financial information while preparations for announcements of financial results are being made, the Company shall set a “Silent Period” in its IR and SR activities in its "IR Policy". In doing so, the Company shall strive to ensure fairness in all of its IR and SR activities.

Cross-shareholdings

In the Basic Policy on Corporate Governance, the Company has formulated its policy on cross-shareholdings in the Group and its approach to the exercise of voting rights as follows.

- Cross-shareholdings shall be held to maintain and strengthen relationships with business alliance partners and joint business partners. As a general rule, holdings for any other purposes shall be reduced.

- Each year, the Company and the Board of Directors of each company of the Group with cross-shareholdings examine whether the shareholdings are appropriate or not by concretely scrutinizing the appropriateness of the purpose of the shareholdings and if the benefits and risks associated with the shareholdings are commensurate with the cost of capital.

- If it is deemed that it is unsuitable to continue with the cross-shareholdings based on the examination results of the above 2 , such cross-shareholdings shall be made subject to sale so as to reduce them.

- Examination details and results of the above 2 and 3 of the Group shall be disclosed annually.

- The Group believes that the appropriate exercise of the voting rights of cross-shareholdings will encourage the establishment of sound corporate governance systems and sustained growth at counterparty companies. At the same time, the Group believes that the appropriate exercise of these voting rights is a crucial means of helping to bolster shareholder interests. Accordingly, the Group shall exercise the voting rights of its cross-shareholdings.

- In the course of exercising voting rights as stipulated in the preceding item, the Company shall strive to share a common awareness with the counterparty company by engaging in dialogue and other forms of communication from a medium- to long-term perspective, while respecting the counterparty company's management decisions, rather than making judgments based on formal standards. In cases where it is judged that shareholder interests could be impaired, the Company shall express its position through the appropriate exercise of its voting rights.

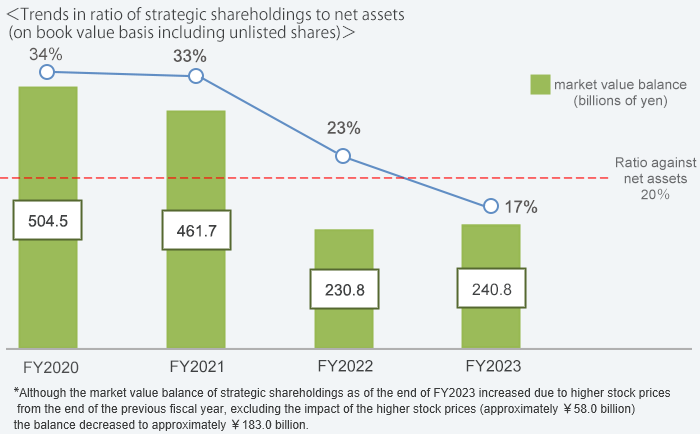

In order to improve capital efficiency, the Group is reducing its strategic shareholdings balance. In May 2024, the Group announced its policy to reduce strategic shareholdings to zero by the end of March 2031, excluding shares of business partners and collaborators. With respect to strategic shareholdings that have been held for the purpose of maintaining and expanding long-term and stable business relationships in the insurance field, the Group has conducted a thorough reassessment of the rationale for such holdings. Based on this review, the Group has decided to proceed with a continuous reduction of the balance.

In FY2024, the balance was reduced by ¥7.5 billion based on market value at the time of sale (reduced by ¥12.2 billion based on market value at the end of the fiscal year). As a result, the ratio of strategic shareholdings to net assets stood at 17%.

Regarding investment stocks held for pure investment purposes, including those whose holding purpose has been changed from strategic shareholdings, Taiyo Life makes decisions on whether to continue holding each individual stock based on factors such as the dividends and stock price outlooks due to medium- to long-term performance growth, through its securities investment department, which is part of its asset management division. Similarly, at Daido Life, such decisions are made by TDAM*, the asset management company of the Group.

Regarding the exercise of voting rights, at Taiyo Life, regardless of the purpose of holding, such as pure investment purpose or strategic shareholdings purpose, the securities investment department, which is independent of departments in charge of lending and corporate sales, etc., is responsible for exercising voting rights.

Similarly, at Daido Life, voting rights for strategic shareholdings are exercised by the investment planning department, which is also independent of departments in charge of lending and corporate sales, etc. For stocks held for pure investment purpose, voting rights are exercised by TDAM*, a separate legal entity. Each company within the Group has established a committee involving third parties such as external experts, which verifies the approval or disapproval decisions and processes when exercising voting rights.

We report the results of exercise of voting rights to the board of directors, etc. and our management team itself verifies whether voting rights are appropriately exercised. Also, the results are disclosed on the websites of each of our Group companies.

*Since July 2024, Daido Life has entrusted the management of stocks held for pure investment purposes to TDAM under a discretionary investment contract. Accordingly, investment decisions and the exercise of voting rights, etc. are carried out by TDAM.

At Taiyo Life, the securities investment department, which is part of its asset management division, is responsible for management of stocks held for pure investment purposes. However, since July 2025, Taiyo Life plans to entrust the management of these stocks, including investment decisions and the exercise of voting rights, to TDAM.In addition, we will not take any actions to obstruct the sale if a company of which we hold shares as strategic shareholdings proposes to sell its shares of our Company.

Disclosure of Information

Disclosing Information and Ensuring Transparency

- The Company shall strive to provide easy-to-understand disclosure based on its core disclosure principles of timeliness, fairness and accuracy in order to maintain and reinforce trust among all of its stakeholders and to increase the level of transparency in its corporate governance.

- The Company shall disclose statutory information stipulated in the Insurance Business Act, the Financial Instruments and Exchange Act, and other related laws and ordinances, and in the rules of the Tokyo Stock Exchange. The Company shall also disclose information it deems to be important for its stakeholders, taking into account the business environment, economic conditions, and industry trends.

- The Company shall strive to disclose information to as many people as possible using various media.

- The Company shall establish Disclosure Rules that set forth the purpose, basic policy, system, activities and other aspects of disclosure, and shall proactively strive to provide disclosure based on those rules.