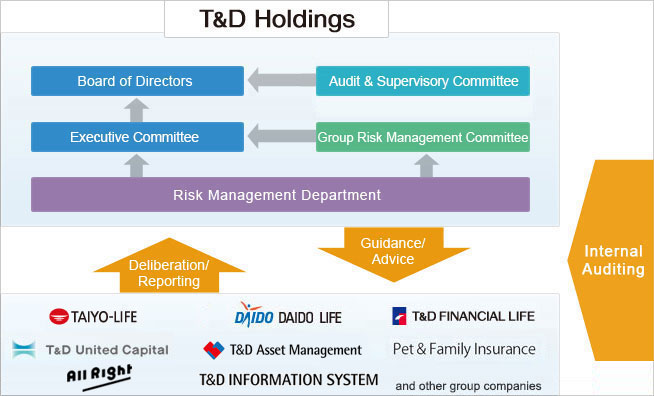

Risk Management System

Given the social publicness and other characteristics of the life insurance business, the T&D Insurance Group considers the accurate understanding and management of risks to be a high-priority management issue for ensuring management soundness and suitability. At the same time, general management is handled by T&D Holdings—the Group holding company—while each Group company is responsible for suitably managing risk in line with its business characteristics and risk profile.

Furthermore, the Group conducts integrated risk management through such means as utilizing risk management indicators based on economic value, which values assets and liabilities on a mark-to-market basis.

Risk Management Policy

T&D Holdings has established a Group Risk Management Policy that sets forth the basic concepts for managing risk within the T&D Insurance Group. Based on this policy, the three life insurance companies have upgraded their risk management systems, including those for affiliates.

T&D Holdings has established the Group Risk Management Committee to integrate the management of risk within the Group. Moreover, the three life insurance companies are required to submit risk status reports, based on integrated risk management indices periodically as well as on an as-needed basis. In this way, T&D Holdings is able to assess the various risks faced by the individual Group companies. Also, T&D Holdings reports the risk status of each Group company to the Board of Directors and, based on these findings, provides guidance , advice, and instructions to the three life insurance companies as necessary. This not only ensures that each of the companies conducts thorough risk management but also strengthens the management of risk for the Group as a whole.

Risk Classifications and Responses

The T&D Insurance Group categorizes and defines risks and takes appropriate responses as follows:

1. Underwriting Risk

This is the risk of incurring losses due to disparities between economic trends or trends in mortality and morbidity rates and forecasts at the time of setting premiums.Based on an awareness of the major impact that life insurance underwriting has on business over the long term, the Group determines, analyzes, and assesses the insurance underwriting risk and carries out appropriate controls.

2. Investment Risk

The T&D Insurance Group classifies and manages investment risk according to three categories: market risk, credit risk, and real estate investment risk.

Also, T&D Holdings monitors the concentration of credit in specific industries/groups and oversees the management/recovery of problem loans.

Market Risk

This is the risk of incurring losses due to changes in the prices of owned assets (including off-balance sheet assets) as a result of changes in interest rates, securities prices, foreign exchange rates, and various other factors.

Credit Risk

This is the risk of incurring losses due to a decline in the price or the complete eradication of the value of assets (including off-balance sheet assets) as a result of a deterioration of the financial positions of obligors.

Real Estate Investment Risk

This is the risk of incurring losses from a decline in real estate-related revenues due to changes in lease fees or other factors, or from a decline in the value of real estate itself due to changes in market conditions.

3. Liquidity Risk

The T&D Insurance Group classifies liquidity risk into two categories: cash flow risk and market liquidity risk.

Cash Flow Risk

This is the risk of incurring losses when an outflow of funds resulting from a major disaster, a deterioration in profitability, or other factors cause a deterioration in cash flows that forces the Company to sell assets at prices significantly lower than normal in order to secure funds.

Market Liquidity Risk

This is the risk of incurring losses due to an inability to trade in the market or being forced to trade at prices significantly lower than normal because of market confusion or other factors.

The T&D Insurance Group has established classifications according to the degree of cash flow tightening, and it has formulated methods for managing each classification to secure a certain level of liquidity. Simultaneously, it carries out risk control to reinforce its system for smoothly liquefying assets to procure funds.

4. Operational Risk

Operational risk is managed by category of risk, namely administrative risk, system risk, legal risk, labor/personnel risk and catastrophe risk.

Administrative Risk

This is the risk of incurring losses due to an officer or employee neglecting to perform operations correctly and/or causing accidents, performing illegal acts, or leaking information. Recognizing that all operations entail administrative risks, the T&D Insurance Group strives to reduce or prevent these risks by strengthening the operational risk management systems at each Group company.

System Risk

This is the risk of incurring losses due to computer system downtime, malfunctions, or other system flaws or the improper use of computers. Cognizant of system risk in all of its operations, the T&D Insurance Group strives to reduce or prevent system risk and minimize losses at the time of risk occurrence by strengthening its management system.

Legal Risk

This is the risk of incurring losses as a result of neglecting to comply with laws and statutory regulations. The T&D Insurance Group strives to prevent the occurrence of legal risk by promoting compliance. Also, if there is a risk of losses, including compensatory damages, due to legal action or other such incident, the Group seeks to minimize losses by seeking early resolution through consultation with legal counsel.

Labor/Personnel Risk

This is the risk of incurring losses due to such labor and personnel problems as those related to hiring, labor management, personnel outflows, and human rights. Recognizing that labor/personnel risk exists for all Group companies, the T&D Insurance Group seeks to reduce or prevent such risk and deal appropriately with unavoidable problems by establishing effective administration systems.

Catastrophe Risk

This is the risk of incurring losses due to a lack of preventative measures in relation to large-scale disasters or not having emergency measures in place when a large-scale disaster occurs. The T&D Insurance Group strives to reduce or prevent catastrophe risk by assuming the possibility of disasters, including major earthquakes and damage due to wind and floods, and establishing preventive measures and strengthening emergency response systems.

5. Reputational Risk

This is the risk of incurring losses due to the spread of negative information about the creditworthiness or negative evaluations of the Group or the life insurance industry among policyholders, investors, or the public at large through the media or the Internet that affects the earnings of Group companies adversely or causes a decline in share price. The T&D Insurance Group works to contain reputations and information related to reputational risk and strives to reduce or prevent reputational risk through an accurate response/reporting system.

6. Affiliate Risk

This is the risk of incurring losses due to deterioration of profitability, materialization of various risks, or other adverse factors at subsidiaries, affiliates, and other business investments of the three life insurance companies, etc.

The T&D Insurance Group works to assess the income/expenditure situation as well as the potential for the occurrence of various risks at subsidiaries, affiliates, and other business investments of the three life insurance companies, etc., and carries out proper risk control.