ERM

ERM (Enterprise Risk Management) refers to a strategic method of corporate management that seeks to maximize corporate value and profits while ensuring the soundness of business through integrated management of capital, profit, and risk.

As opposed to passive risk management, which considers risk something to be avoided, in ERM, risk is not something only to be eliminated or reduced, but rather, the risks that should be taken on to pursue growth in profitability are selected actively while limiting risk to a fixed scope of capital to maintain sound management of business operations.

T&D Holdings, Inc. quantitatively assesses capital, profit, and risk on an economic value basis, setting standards for soundness and profitability in its "Group Risk Appetite." We have also established the Group ERM Committee for the Group to work as one to promote ERM. We are working to enhance the Group's corporate value in a stable and continuous manner by promoting ERM through the "PDCA Cycle" of formulating a management plan which meets the Group Risk Appetite (Plan), implementing the planned initiatives (Do), monitoring the progress of implementation of the plan (Check), and reviewing the plan as necessary (Action).

Please see the below for an explanation of EV (ROEV) and ESR.

EV

The Group has established EV (Embedded Value) as an indicator of corporate value, and stably and sustainably increasing EV is one of our management targets.

Definition of EV

In general, life insurance policies are extremely long-term, spanning 10 years, 20 years, or even the lifetime of the policyholder, meaning time gaps develop between the recognition of the incurrence of earnings and costs.

For example in financial accounting, especially for companies which are strong in acquiring new contracts, many initial costs such as sales commissions are incurred, and it appears that profit is falling in that year. However, for insurance earnings, as insurance premiums are received yearly, earnings are incurred gradually over time and the scheme raises revenue over the long-term.

Considering the time lag between when insurance companies recognize earnings and costs, an "Embedded Value (EV)" yardstick is used as a means to measure the corporate value of life insurance companies.

The concept of EV totals "the future profits which can be acquired from contracts currently held " and "asset value of certain liabilities, etc. which are actually viewed as capital added to shareholders' equity " to show the amount of net assets after taxes that would be attributable to shareholders.

ROEV

In addition to the commonly used "ROE (Return on Equity)" as an indicator of capital efficiency, considering the specificities of life insurance accounting, the Company uses "ROEV (Return on Embedded Value)," which is calculated using EV.

The Company has set an ROEV of 7.5% and above and a core ROEV, centered on increased EV in new business acquisition, of 5.0% and above as medium- to long-term targets in our Group Risk Appetite.

(*1) ROEV: Annual increase in EV (less capital movements)/Annual average of EV

(*2) core ROEV: (Embedded value of new business + Expected existing business contribution from risk free rate)/Annual average of EV

ESR

The Group has introduced ESR (Economic Solvency Ratio) as a financial soundness indicator based on economic value, and by controlling ESR within a set range, the Group works to maintain financial soundness and capital adequacy.

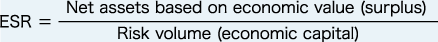

ESR is calculated by dividing net assets based on economic value (surplus) valuated with the same assumptions as EV by the risk volume quantified using our internal model (economic capital) (*1).

(*1) Investment risk, insurance underwriting risk, operational risk, etc., are measured using the Value at Risk criterion (hereinafter referred to as “VaR”) with the amount of losses at VaR 99.5% and a measurement period of one year

Minimum level of ESR of 133% in the Group Risk Appetite represents the capital level needed to cover VaR 99.93%.