Disclosure of Climate-related Financial Information Based on the TCFD Recommendations

The Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB), formulated its recommendations for clarified, comparable, and consistent information disclosure regarding the risks and opportunities posed by climate change. These recommendations were announced in June 2017. Climate change is an issue to be addressed on a global scale. The effects of climate change have significant impacts on the lives of people, through changes in economic behaviors and society worldwide. The T&D Insurance Group has expressed its support for the TCFD recommendations, and is actively committed to disclosing climate-related financial information in an easy-to-understand manner.

Disclosure of climate-related financial information

Governance

Oversight by the Board of Directors

- The Board of Directors has established the Group Sustainability Promotion Committee as its subsidiary body, with the task of reviewing and deliberating its policies related to SDGs and CSR, along with measures concerning the global environment and social issues.

- The Group Sustainability Promotion Committee is chaired by the Representative Director and President, who concurrently serves as chairperson of the Board of Directors, and consists of the directors and general managers in charge of Sustainability/CSR and investment management departments at Group companies. The Committee formulates basic policies regarding the global environment and social issues such as SDGs, and the targets and initiatives for climate change action. It is supervised by the Board of Directors, monitoring of the status of the initiatives is implemented every six months, and a report is made to the Board of Directors.

- To promote the initiatives of the Group Sustainability Promotion Committee, we have established the Sustainability Advisory Committee, Sustainability Promotion Subcommittee, ESG Investment Subcommittee, and Social Impact Study Subcommittee as subsidiary bodies to the Group Sustainability Promotion Committee.

- The Sustainability Promotion Subcommittee investigates and reviews the status of and necessary measures for climate change risks and various sustainability issues, and reports to the Group Sustainability Promotion Committee. The ESG Investment Subcommittee enhances the sharing of information within the Group related to ESG investments aimed at simultaneously improving profitability and resolving social issues, thereby supporting the steady implementation of ESG investments by the Group as a whole as well as its sustainable growth. We also have a Sustainability Advisory Committee attended by outside experts, to incorporate the perspectives of such experts as well as information on the latest trends and to enhance the Group’s sustainability-related efforts.

Role of Management

- The Company has established the Executive Management Board as a body for deliberating on and passing resolutions related to matters that are important in terms of the management of both the Company and the Group, and, in parallel, the Group Strategy Board has been established to deliberate on matters related to the Group Growth Strategy and other relevant and important matters from the perspective of the Group as a whole in order to achieve sustainable improvement in the Group’s corporate value.

- The Sustainability Promotion Department has been established to specialize in promoting the sustainability of the Group as a whole, including our response to climate change, and this department formulates our basic policies related to various sustainability issues, promotes specific related measures, and monitors the progress. The Sustainability Promotion Department also serves as the secretariat of the Group Sustainability Promotion Committee, and the Executive Management Board and the Board of Directors receive detailed reports on all basic policies and measures related to the global environment and social issues that are deliberated on by the Group Sustainability Promotion Committee.

Strategies

- The following scenario analysis was carried out in order to assess the impact of climate change risks (physical risks*1 and transition risks*2) on the Group.

*1 Business risks associated with natural disasters caused by extreme weather such as typhoons and floods, and those associated with phenomena such as an increase in the average temperature and a rise in the sea level

*2 Business risks arising from the actions of government, corporations, and consumers in the process of carrying out the transition to a low carbon or decarbonized society (through a significant reduction of greenhouse gas emissions)

Scenario analysis: What the World Looks Like Under Each Scenario

| The world under the 1.5°C scenario | The world under the 4°C scenario |

|---|---|

|

|

| Physical effects caused by a rise in average temperature (1.5°C scenario < 4°C scenario) |

|---|

|

| Impact of the transition to a society with low or net-zero carbon emissions (1.5°C scenario) |

|---|

|

Scenario analysis: Impact on the Group and Response Measures

| 1.5°C scenario | 4°C scenario | ||

|---|---|---|---|

| Physical risks | Impact on underwriting profitability |

|

|

| BCP response |

|

|

|

| Transition risks | Impact on asset management income |

|

|

Reference data: Physical risk scenarios: RCP2.6 and RCP8.5, Transition risk scenarios: NGFS and Bank of England

Scenario analysis: Business Opportunities for the Group

- Changes in the morbidity rate and average life expectancy associated with the progress of global warming are expected to give rise to needs for protection (involving death, annuities, and medical care) against emerging risks. There are opportunities to expand net sales of the insurance business, by expanding and providing a wider scope of protection in order to meet such emerging needs.

- As the reduction of GHG emissions progresses, the Group, as an institutional investor, has opportunities to enhance the value of investment assets and expand investment returns stably over the long term, by investing and lending to expanding clean energy development and energy conservation businesses, and by owning and managing real estate (such as office buildings) with superior environmental performance.

- The Group also has opportunities to expand its business domains and earnings as a business operator, rather than as an institutional investor, by developing or entering into new business domains related to the mitigation of and adaptation to climate change.

More sophisticated climate change risk analysis: Quantitative analysis of effects on the Group

We collaborated with KPMG Consulting Co., Ltd. and the Japan Weather Association (called the JWA below) to conduct a quantitative analysis of effects on the Group in order to increase the sophistication of our climate change risk analysis.

Analysis method

- The JWA developed a high-resolution climate scenario dataset by setting up a 1-km mesh for climate-change prediction data in order to analyze physical risks.

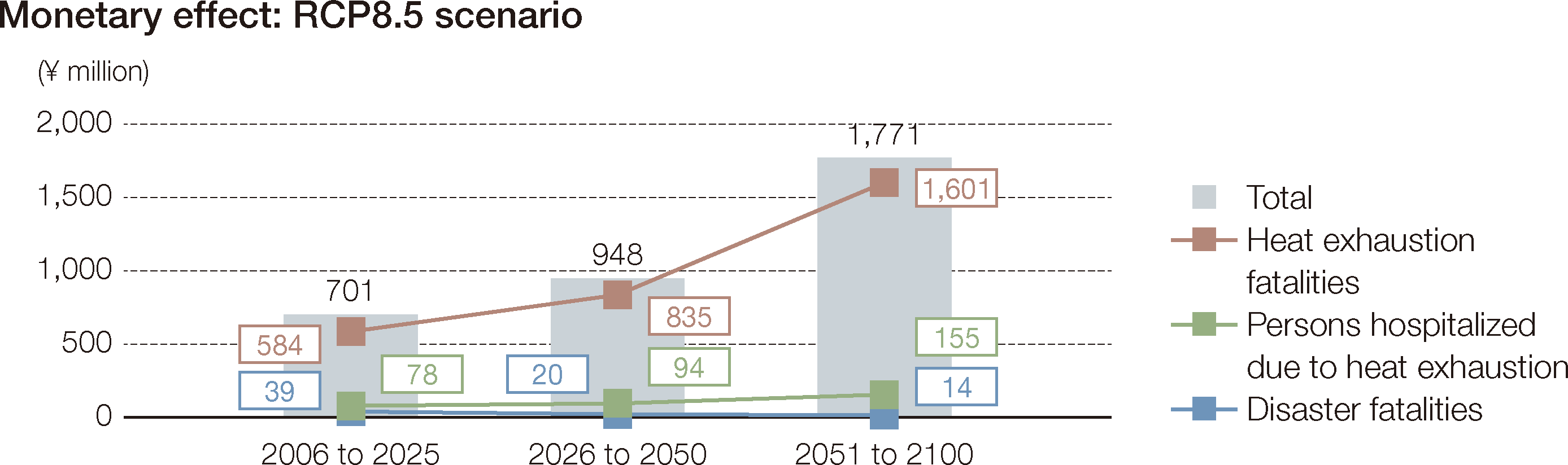

- Next, two models were developed for the Group—one for estimating the number of victims of flooding and another for estimating the number of people hospitalized/fatalities due to heat exhaustion—assuming that Japan’s future average temperature increases by either 2°C (the RCP2.6 scenario) or 4°C (the RCP8.5 scenario) due to climate change. Five climate prediction models were utilized for our estimates.

- We divided the future period up through 2100 into two periods, the near future period from 2026 to 2050 and the distant future period from 2051 to 2100, and then conducted a physical risk analysis.

Analysis results

Disaster victims

- There is variation between regions in terms of future increases in rainfall (with rainfall decreasing in some regions).

- In addition, although there will be an increased rate of powerful typhoons, the number of typhoons is expected to decrease.

⇒In both scenarios, although there is a possibility of a sudden spike in the number of disaster victims in the case of extremely heavy rainfall, the number during the entire period is about the same.

Number of people hospitalized/fatalities due to heat exhaustion

- Regardless of the scenario, there is not that much of a change during the near future period.

- During the distant future period, the number of extremely hot days and tropical nights will increase. In particular, in the RCP8.5 scenario, the number of extremely hot days is expected to increase by more than a month compared to the present.

⇒In both scenarios, the number of people hospitalized/fatalities due to heat exhaustion is expected to increase during the distant future period.

Effects on the Company

- According to our calculations based on our analysis results, in the case of the RCP8.5 scenario—which has a greater effect—compared to the base period (2006 to 2025), both insurance claims and benefits will increase in the distant future period by ¥510 million to ¥1.63 billion (equivalent to approximately 0.1% to 0.3% of the Group’s paid out insurance claims and benefits).

* The graph below shows the average of all five models. (Increase of ¥1.07 billion in the distant future period)

Risk management

Risk Identification and Assessment Process

- The Group exhaustively classifies the risks it faces through use of a risk profile, with a view toward dealing with increasingly diverse and complex risks. Risks are listed exhaustively by risk category. The Group then identifies and assesses these risks, and prioritizes initiatives by considering factors such as each risk’s significance, potential impact, and current status of control, which are then reflected in management plans, as necessary. The Group registers climate change-related risks on the risk profile as critical risks to be managed, and scrutinizes, identifies, and assesses these risks. Climate change-related risks are identified and assessed as insurance underwriting risk, asset management risk, operational risk, reputational risk, and risks that may have broad-based impacts on overall management.

Risk Management Process

- In order to identify and grasp newly emerging risks, as well as changes in risks that have already been identified, a review of the risk profile is carried out twice per year, and reported to the Group Risk Management Committee and the Board of Directors.

- In the process of identifying and assessing risks on a company-wide basis through a risk profile, climate change-related risks are managed using the perspectives shown below.

Management of climate change-related risks

1) Physical risks

- The Group considers the mitigation of the deterioration of underwriting profitability through reinsurance and other means, along with large-scale disaster risks (insurance underwriting risks).

- The Group monitors existing products and implements countermeasures, including product revisions, as necessary.

2) Transition risks

- The Group engages in investments and borrowings, taking into account climate change-related risks based on the Principles for Responsible Investment (PRI).

- The Group promotes investees and borrowers to respond to decarbonization through engagement.

- The Group monitors trends in economic policies, laws, and regulations, and share the information across the Group, through the Group Sustainability Promotion Committee and the Group Management Promotion Committee. Measures are taken to ensure that the Group responds to such trends in a sufficiently effective manner at the level expected of a listed company.

Metrics and targets

- The Group establishes its environmental protection-related targets and is working on initiatives to achieve them in its daily business activities. The four targets are “to reduce CO2 emissions,” “to reduce electricity consumption,” “to reduce office paper consumption,” and “to improve the green purchasing ratio.” Progress toward the achievement of these targets is measured annually, and disclosed in various reports and websites.

- As for CO2 emissions, Scope 1 (direct emissions from the Company), Scope 2 (indirect emissions via the purchase of energy including electric power), and Scope 3 (indirect emissions via other corporate activities including procurement of materials, transport, and disposal) are measured and disclosed on a continuous basis.

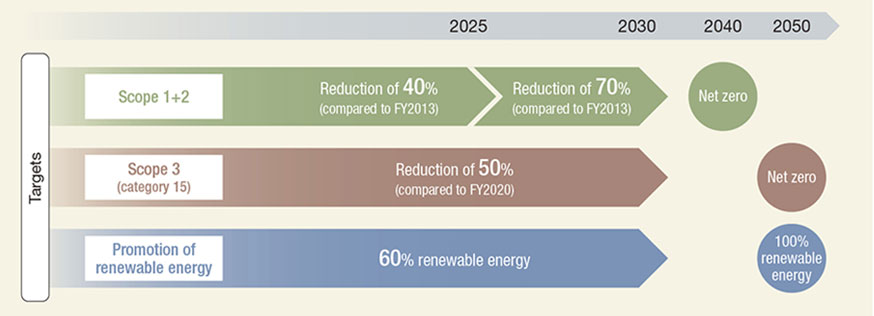

- We have set reduction targets for our own emissions (Scope 1 and 2) and for our investees and borrowers (Scope 3: Category 15), aiming to achieve net zero emissions by 2040 and 2050 respectively.

Roadmap to achieving net zero

CO2 emissions reduction target

| Subject | Targets |

|---|---|

| Own emissions (Scope 1 and 2) |

FY2025: 40% reduction (compared to FY2013) FY2030: 70% reduction (compared to FY2013) FY2040: Net zero |

|

Investees and borrowers (Scope 3: category 15) |

FY2030: 50% reduction (compared to FY2020)

* Subjects are stocks, corporate bonds, and financing of domestic listed companies. |

Promotion of renewable energy introduction

- We are a member of RE100, a global initiative that aims to use renewable energy sources to cover all electricity consumed in business activities.

- We have set an interim goal of sourcing 60% of our electricity from renewable energy by fiscal 2030, and are actively promoting the use of renewable energy.