Among the various sustainability fields that relate to its business activities, the T&D Insurance Group has identified social issues that are highly important to society and highly relevant to the Group’s operations. Based on this, we established the following four sustainability priority themes.

![image:[Priority theme 1] Promote Healthy and Abundant Lives for People [Priority theme 2] Provide Workplace Environments that Enable Diverse Human Resources to Participate Actively [Priority theme 3] Contribute to Global Environment Conservation and Climate Change Mitigation and Adaptation [Priority theme 4] Invest to help build a sustainable society](/en/csr/effort/images/casestudy_24-01.png)

- Priority Theme 1 Promote Healthy and Abundant Lives for People

- Priority Theme 2 Provide Workplace Environments that Enable Diverse Human Resources to Participate Actively

- Priority Theme 3 Contribute to Global Environment Conservation and Climate Change Mitigation and Adaptation

- Priority Theme 4 Invest to Help Build a Sustainable Society

Process for Selecting Priority Themes

(1) Identify important social issues

We considered various social issues to be targeted, based on what society expects of us as a Group engaged mainly in the insurance business, as well as how we can help develop a sustainable society.

After examining the SDG goals and targets, our Group Sustainability Charter, changes in the social environment, trends in technological innovation, and other sources, we identified 40 (important) target-related social issues relevant to our policies, products, services, and business model.

(2) Identify initiatives that address the important social issues

We identified the initiatives that have been implemented to increase social value with respect to the important social issues through our business activities and our critical business and sustainability management platforms.

(3) Identify the shared value to be realized by the initiatives and the corresponding sustainability themes

We identified initiatives that address important social issues and the shared value of their impact. In order to create shared value, we set themes that promote Group sustainability from the perspectives of the areas of the issues to be addressed and the ways of addressing them.

For more details on (2) and (3), please see “Initiatives for Solving Social Issues and Creating Shared Value”.

(4) Prioritize shared values and sustainability themes

We evaluated the importance of each shared value and sustainability theme based on both a) importance to society, and b) relevance to the Group’s business and initiatives (influence on social issues). We then clarified the priority of the initiatives for the Group to pursue.

a) Importance to society: Evaluation based on its impact on the economy, environment, and society and its contribution to the SDGs

b) Relevance to the Group’s business and initiatives: Evaluation based on the relationship with policies and actions defined in the T&D Insurance Group Sustainability Charter

(5) Select sustainability priority themes

We set priority themes for promoting Group sustainability that can have an impact on the creation of shared value by addressing important social issues. Every year, we review priority themes and check whether they are necessary, in order to reflect developments, including changes in society and the environment, in our sustainability management.

(6) Verify the adequacy of important social issues and sustainability priority themes

- We engaged in dialogue and exchanged views on the selection process of priority themes with a qualified third party, then confirmed the adequacy of social issues to be targeted and the validity of our priority evaluation.

- In addition, we received approval from the Group SDGs Committee(now the Group Sustainability Promotion Committee) and reported to the Executive Committee (now the Executive Management Board) and Board of Directors.

Progress Management and Verification of Initiatives

The Group Sustainability Promotion Committee formulates annual plan for priority theme activities, and regularly checks progress with its implementation. Those developments are regularly reported to the Board of Directors.

Initiatives for Solving Social Issues and Creating Shared Value

The T&D Insurance Group is committed to creating shared value and contributing to solving social issues through the Group’s broad range of business activities.

Priority Themes for Promoting Group Sustainability

Our priority themes for promoting Group sustainability, where they are described, and the corresponding GRI topics are shown below.

<Shared value and sustainability theme>

Healthy and abundant lives

[Priority theme 1]

Promote Healthy and Abundant Lives for People

(Insurance products and services)

The provision of products and services that contribute to dealing with various risks faced by our customers, which are the result of societal changes such as the acceleration of Japan’s declining birthrate and aging population, is an opportunity for the Group to both grow and contribute to the health promotion of our customers.

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By providing insurance that supports the prevention of dementia as well as insurance that offers coverage for a wide range of conditions requiring long-term care, we will mitigate the financial and social risks faced by an aging society. | P.27–30 | Measures against demographic change and aging Better products and services 203: Indirect Economic Impacts 417: Marketing and Labeling |

|

By integrating Internet-based insurance enrollment with face-to-face support service, responding to the insurance enrollment needs of foreign workers, and offering protection-oriented products at an affordable price, we will promote easier access to insurance products. | P.33–35 | |

|

By providing products and services in response to SME needs, we will contribute to the establishment and growth of SMEs as well as the health promotion of their employees. | P.31–33 | |

|

To avoid possible impacts of customers not being able to obtain accurate or sufficient information, we will promote the provision of suitable product and service information while also strengthening our initiatives to respond to customer feedback. |

P.34–35 P.41–42 |

<Shared value and sustainability theme>

Employment and job satisfaction

[Priority theme 2]

Provide Workplace Environments that Enable Diverse Human Resources to Participate Actively

(Workplaces and personnel)

We believe that creating a healthy and safe working environment that responds to the needs of society is necessary to achieve a sustainable society and simultaneously serves as an opportunity to further vitalize the Company, so we are promoting various initiatives accordingly.

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By implementing initiatives to support human resources and skills development, we will enhance employee skills, encourage career development, and increase the appetite of employees for growth. | P.45–46 | 401: Employment 404: Training and Education |

|

By actively promoting both respect for worker personalities and diversity as well as the active participation of women, we will nurture a corporate culture where a diverse workforce can feel job satisfaction and reach its potential. | P.47–49 | 405: Diversity and Equal Opportunity |

|

By creating a healthy and safe working environment, we will reduce the mental and financial impact on employees while helping them to demonstrate their abilities and enhance their performance. | P.50–53 | 403: Occupational Health and Safety |

<Shared value and sustainability theme>

Sustainable global environment

[Priority theme 3]

Contribute to Global Environment Conservation and Climate Change Mitigation and Adaptation

(Climate change)

While climate change on a global scale is a risk for the continuity of the Group’s business activities as both a provider of insurance products and services and an institutional investor, climate change is also an opportunity to undertake new activities.

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

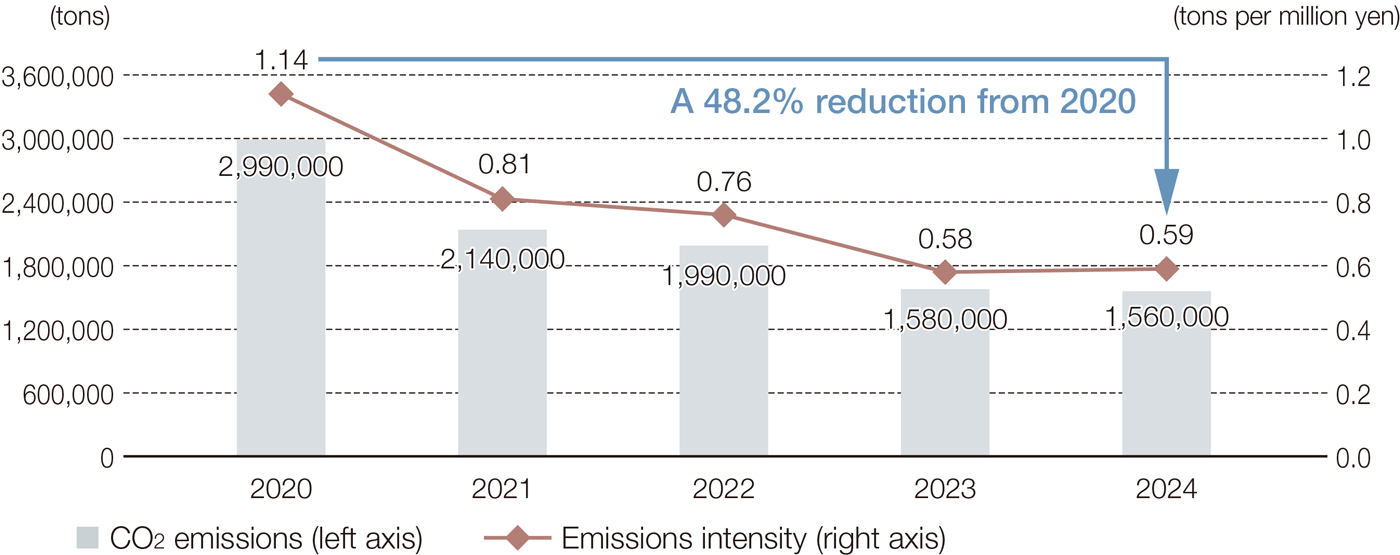

By increasing use of renewable energy, improving energy efficiency, etc., we will considerably reduce CO2 emissions caused by our business activities. We will analyze the impact of physical and transition risks related to climate change on our activities as both an insurance-product provider and institutional investor, and we will strive to reduce these risks and increase our opportunities. |

P.57–67 | 302: Energy 305: Emissions 201: Economic Performance |

<Shared value and sustainability theme>

A resilient and vibrant society

[Priority theme 4]

Invest to Help Build a Sustainable Society

(Investment and lending)

By considering the environment, society, and corporate governance when conducting investment activities as an institutional investor engaged in long-term fund management, we will contribute to the achievement of a sustainable society.

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By conducting investing and lending activities from a long-term perspective that considers ESG factors, we will mitigate ESG risks and contribute to the sustainable growth of investment and loan recipients as an institutional investor. |

P.69 | Responsibilities as an institutional investor 203: Indirect Economic Impacts |

|

P.71–75 |

Foundational Themes for Promoting Group Sustainability

The relationships between sustainability themes that are foundational for promoting our priority themes and social issues, where they are described, and the corresponding GRI topics are shown below.

<Shared value and sustainability theme>

Governance and internal control of trusted corporate groups

・Building a fair business foundation

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By strengthening our governance and internal control related to responsible business practices to prevent corruption, we will prevent impacts on the Group itself as well as social and economic systems. | P.101–102 | 205: Anti-corruption 206: Anti-competitive Behavior |

|

By strengthening our information security systems, we will prevent impacts due to the leakage of personal information. | P.99–100 | 2-27: Compliance with laws and regulationse 418: Customer Privacy |

|

Regarding taxes regarded by the UN as playing an essential role in terms of achieving the Sustainable Development Goals, we will implement suitable tax payment and information disclosure in line with relevant laws and ordinances. | P.103 | 207: Tax |

<Shared value and sustainability theme>

Respect for human rights

・Other social human rights

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By preventing discrimination and harassment based on gender, disabilities, race, and sexual orientation, we will prevent related negative impacts on human rights. | P.22–24 | 2-24: Embedding policy commitments 2-25: Processes to remediate negative impacts |

<Shared value and sustainability theme>

Sustainable global environment (biodiversity, resources, forests, and pollution prevention)

・Efficiently using resources and energy

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By pursuing office paper and other initiatives to enhance the efficiency of resource use and increase reuse and recycling activities, we will reduce environmental impacts, such as natural resource depletion, environmental problems, and pressure on waste disposal sites. | P.63 | 301: Materials 303: Water and Effluents |

<Shared value and sustainability theme>

Sustainable global environment (biodiversity, resources, forests, and pollution prevention)

・Environmental protection of land and sea

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By promoting the recycling of plastic bottles, we will prevent ocean pollution. By promoting tree planting, we will contribute to the preservation of biodiversity. |

P.62 | 304: Biodiversity 306: Waste |

|

<Shared value and sustainability theme>

Resilient and vibrant society (community contribution activities)

・Support for basic education

・Basic living infrastructure

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By conducting social contribution activities, we will contribute to improving the social environment in terms of aging, health, education, poverty, and the environment. | P.84–88 | Measures against demographic change and aging |

|

Promoting community and employee health 413: Local Communities |

<Shared value and sustainability theme>

Revitalization of partnerships / Collaboration with stakeholders

| Important social issue | Impact of initiatives to respond to social issues | Locations in the Sustainability Report 2025 | GRI topics |

|---|---|---|---|

|

By engaging with stakeholders, we will enhance our organizational transparency to gain their trust, which is essential for our long-term growth. | P.19 | 414: Supplier Social Assessment |

Contribution to SDGs

At the United Nations Sustainable Development Summit 2015, “Transforming Our World: the 2030 Agenda for Sustainable Development” was adopted unanimously. The agenda sets forth Sustainable Development Goals (SDGs), consisting of 17 goals and 169 targets, for the realization of sustainable development at the global level through the cooperation of the global community, including national governments, ordinary citizens and private-sector corporations.

The SDGs are aimed at realizing a sustainable world through initiatives that address issues in a wide range of fields. SDGs are in line with the Group’s corporate philosophy of “aiming to be a group that contributes to all people and societies through the creation of value.” The Group will continue to incorporate contributions to SDGs into the process for selecting sustainability priority themes and make efforts to contribute to achieving SDGs through our initiatives to promote sustainability, taking advantage of the features and strengths of the business.

Sustainability Priority Themes and SDGs

| Sustainability priority themes | Main related SDG targets | Initiatives |

|---|---|---|

|

1. Promote Healthy and Abundant Lives for People |

|

We will contribute to the sustainable growth of society and to the solution of social issues through the insurance business by offering high-quality, optimal products and services that meet customer needs. |

|

2. Provide Workplace Environments that Enable Diverse Human Resources to Participate Actively |

|

To respect the human rights of all people and respect the personalities and diversity of our employees, we ensure a healthy and safe working environment and develop our human resources. |

|

3. Contribute to Global Environment Conservation and Climate Change Mitigation and Adaptation |

|

We will contribute to climate change mitigation and adaptation and work to create a net zero society and conserve biodiversity through our own business activities as a provider of insurance products and services to customers. |

|

4. Invest to Help Build a Sustainable Society |

|

As a responsible institutional investor, we will secure stable long-term investment income and contribute to the realization of a sustainable society through investment activities undertaken in consideration of the environment, society, and corporate governance, with the aim of growing sustainably in partnership with society. |

Priority Theme 1

Promote Healthy and Abundant Lives for People

Basic Concept

With the main business of the T&D Insurance Group being the life insurance business, contributing to promote healthy and abundant lives for people is one of our most basic responsibility to society. We have positioned “Providing Better Products and Services” as the first principle of the T&D Insurance Group Sustainability Charter. The Group clearly states its commitment to fulfilling its responsibilities to society through the insurance business by offering wellsuited, high-quality products and services that meet customer needs. The provision of products and services that contribute to solving various risks faced by our customers, which occur due to societal changes such as the acceleration of Japan’s declining birthrate and aging population, is both the Group’s mission and an opportunity for growth.

Reduce economic and social risks in an aging society

Japan became an aging society in the 1970s, and the percentage of elderly people continues to rise today. Along with this, the disease structure is changing, and the number of people that require nursing care is expected to increase. In addition, problems due to cognitive decline and other issues are also anticipated.

The T&D Insurance Group is striving to ensure that, even in an aging society, everyone can live a fulfilling life by providing coverage and services that elderly customers and their families can use with peace of mind.

Best Senior Service

Based on the social situation that the aging of society is progressing, we are carrying out Groupwide efforts to improve the convenience and satisfaction of our elderly customers. The Group’s three life insurance companies have named these initiatives the Best Senior Service (BSS), and, through these initiatives, we are developing a variety of service improvements.

Measures at the time of enrollment

The Group’s three life insurance companies recommend that family members be present during the enrollment process. This is to ensure a full understanding of the contents of the insurance policies customers are enrolling in, allowing them to do so with a sense of ease. At Taiyo Life, staff members at headquarters use mobile devices to videoconference with customers to reconfirm customers’ intentions regarding contracts and declaration (for some products). T&D Financial Life employs universal color designs in solicitation materials for customers with color vision deficiencies and universal design fonts that reduce reading mistakes. This helps customers accurately understand the contents, systems, and important matters regarding recommended products.

Designated Proxy Application Rider

The Designated Proxy Application Rider is introduced to customers for insurance policies in which the insured is the beneficiary of insurance claims, etc. In cases where it becomes difficult for the insured to file an insurance claim due to sickness, accidents, or other reasons, a representative who is designated in advance (a preregistered proxy) can file a claim.

Family Registration Program

We introduced the Family Registration Program, which is a system that enables family members registered in advance by a policyholder (registered family) to act as a proxy to verify policy details and obtain various claim forms on behalf of the policyholder.

Measures during enrollment

Taiyo Life launched the Senior Anshin Support Activities in July 2014 as a visiting service activity designed for customers who are seniors. Its staff visit them at least once a year. Now its staff visit or call senior customers at least once a year to confirm contract details and clearly and caringly check for unclaimed benefits, thereby providing peace of mind to each customer.

Daido Life recommends that family members be present for changes made to a policyholder or beneficiary, so that they can understand what the procedures entail and continue with a policy with peace of mind.

T&D Financial Life Insurance provides SMS (short message) delivery services to customers for addressing verification when mail is undeliverable, to encourage payment when premiums are overdue, and to notify customers who have not claimed hospitalization benefits.

Measures for the prompt payment of insurance claims

To prevent missed claims, we regularly confirm with customers of a certain age or older whether there are any unclaimed insurance benefits.

Taiyo Life offers the Kaketsuke-Tai Service, in which administrative personnel with specialized knowledge visit customers and their families to lighten the burden of benefit claim procedures and provide meticulous support. Moreover, by making the procedures for claiming benefits paperless, customers can check the details of their claims and complete procedures by simply signing on their mobile device.

T&D Financial Life is working to improve convenience for customers by making procedures easier to complete. It is taking steps to expand the procedures that can be completed by telephone, revise claim documents and use colors for them, and eliminate the need to submit insurance certificates, seal registration certificates, and other documents.

Measures to improve treatment of customers and hospitality

In order to provide courteous and careful services in response to customers’ situations, Daido Life has formulated and uses a service manual taking into account the general characteristics of senior customers, such as changes in physical abilities and psychological aspects, as well as visual aids. Through these means, we are striving to provide an environment in which our customers can complete necessary procedures with peace of mind. To ensure that senior customers can complete procedures with confidence, T&D Financial Life provides a dedicated toll-free number for customers 85 years old or older.

Nursing Care Coverage

As a result of the aging of society, the number of people requiring nursing care under the public long-term care insurance system and the number of elderly people with dementia are increasing. In response, the Group’s three life insurance companies provide insurance products that cover dementia and nursing care.

Taiyo Life offers dementia insurance and other products that are available even to customers with concerns about their health condition or nursing care needs. Daido Life offers Kaigo Relief α, which provides broad coverage for nursing care conditions, including dementia, and enables SME owners and individual business owners to use insurance benefits to ensure business continuity. T&D Financial Life offers riders that provide coverage for nursing care and dementia, such as the Nursing Care and Dementia Prepayment Rider. This rider provides for the advance payment of death benefits if the insured is certified as requiring Care Level 4 or above under the public longterm care insurance system, or if a diagnosis of certain types of dementia has been confirmed.

In addition, Daido Life and T&D Financial Life provide the ancillary Kaigo Concierge* service with certain policies.

*Kaigo Concierge is a service in which care professionals respond to a wide range of questions and concerns related to nursing care. Depending on customer needs, it also provides referrals to nursing care facilities and care managers, as well as dementia care services that can be combined with public long-term care programs, all at preferential rates.

Help people maintain good health

As stated in our sustainability priority theme, Promote Healthy and Fulfilling Lives for People, helping people maintain good health is an important role that life insurance companies fulfill. In today’s aging society, extending healthy life expectancy has become increasingly important, while advances in medical technology have also driven up medical costs. These challenges have further underscored the importance of supporting health. The T&D Insurance Group helps people maintain good health by providing a wide range of products and services, from prevention to protection against unexpected events.

Prevention Initiatives

By engaging in prevention and health promotion, individuals can improve their quality of life (QOL) and also ease concerns about the future. To help people maintain good health and lead happy lives, the T&D Insurance Group provides products and services that support prevention.

Preventive Insurance Series

Our goal at Taiyo Life is to help create a society where everyone can live long, healthy lives in the era of the 100-year life. To accomplish this goal, we are working on initiatives that not only support customers in terms of detecting and improving dementia and critical illnesses at an early stage, but also help prevent disease and improve customers’ health.

As part of these initiatives, we have developed the Preventive Insurance Series of products which supports customers’ prevention efforts through insurance. In October 2018, we launched our Himawari Dementia Prevention Insurance as the first of these products to help deal with dementia, a social issue, and enable older customers to live with peace of mind.

At the end of April 2025, sales of our dementia-related products* exceeded 1,000,000 policies, which shows that these products are well-received by many people, particularly by our senior customers.

Furthermore, in June 2021, we launched Cancer and Critical Illness Prevention Insurance, the second in our series of prevention insurance plans. This product covers certain conditions, including cancer, strokes, and acute myocardial infarctions, and has been well received by a wide range of customers of all ages, including the middle-aged generation.

*Total sales of Himawari Dementia Prevention Insurance, Himawari Dementia Treatment Insurance, Dementia Treatment Insurance (Mild Nursing Care), Increasing Dementia Treatment Whole Life Insurance, and Whole Life Dementia Pension (My Kaigo Plus).

Prevention service

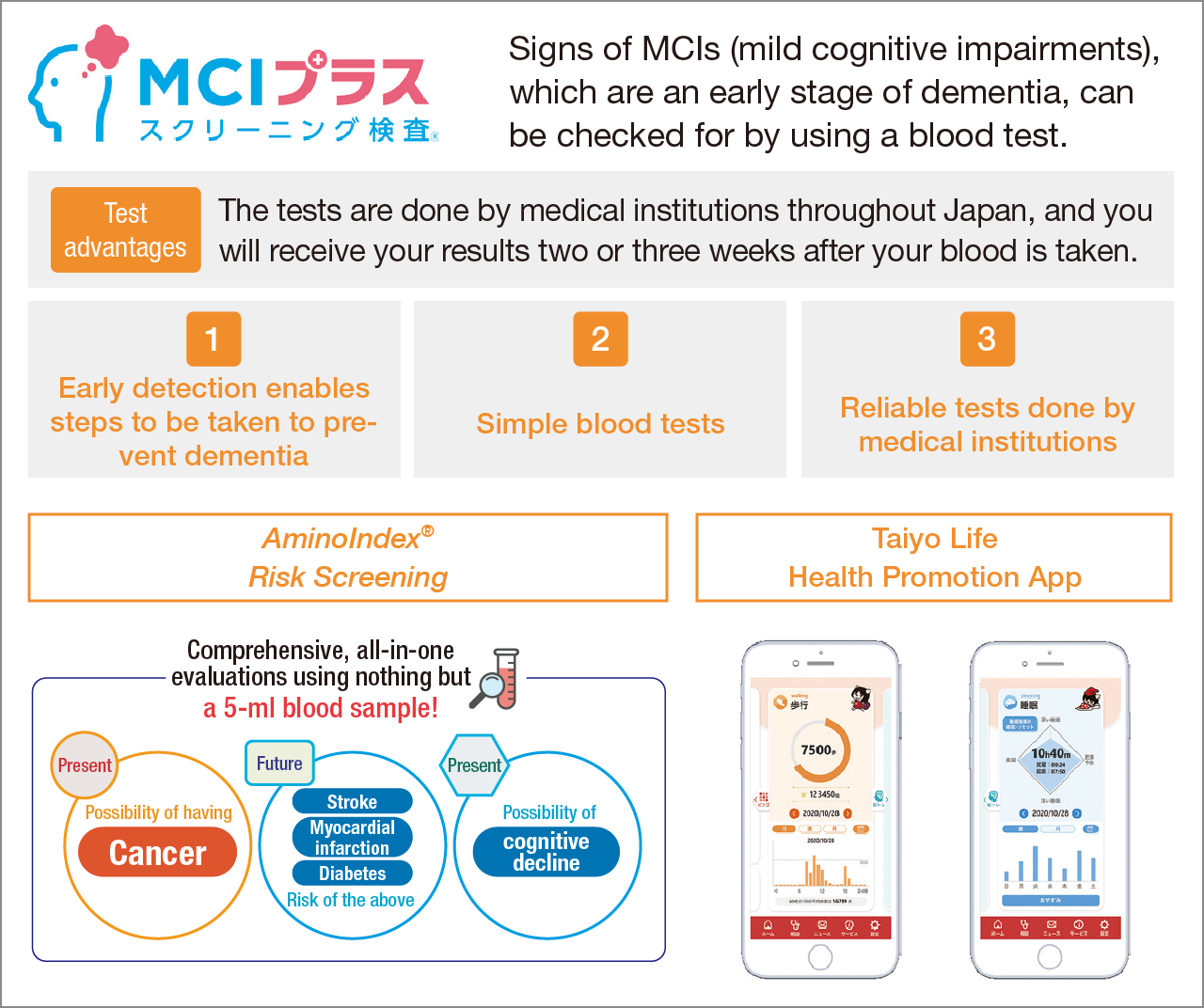

At Taiyo Life, for customers enrolled in our Himawari Dementia Prevention Insurance, we recommend dementia prevention services such as MCI Screening Plus, which determines the risk of mild cognitive impairments (MCIs) through a simple blood test, and the Kurort® Health Walking Experience Tour, which can prevent disease and improve health, among other benefits. In addition, in March 2021, we entered into a business agreement with Ajinomoto, H.U. Frontier, and H.U. Wellness, and offer AminoIndex® Risk Screening, which can simultaneously evaluate the possibility of an individual currently having cancer and whether they are at risk of future strokes, myocardial infarctions, diabetes, and possible cognitive decline. We also made it possible for customers to undergo MCI Screening Plus and AminoIndex® Risk Screening examinations as part of mobile medical services, thereby increasing opportunities for such testing and contributing to the health promotion of our customers.

Moreover, we have started providing the Taiyo Life Health Promotion App based on the concept of “improving health in a fun way using an app,” which can support the health promotion of customers from a variety of perspectives, including walking and sleeping. This app has functions that give advice based on the number of steps walked and hours of sleep every week regarding possible illnesses and conditions that can be prevented and for health promotion, so that customers can confirm their own state of health.

Preparing for Illness, Injury, and Other Unexpected Events

Life insurance allows individuals and their families to receive medical treatment without financial worries in the event of illness or injury, and it provides protection to ensure that family members can continue their lives with peace of mind in the event of death. As a Group centered on life insurance, we provide coverage against a wide range of risks, helping people lead fulfilling lives.

In December 2024, Taiyo Life revised its Hoken Kumikyoku Best lineup to better meet the diverse needs of our customers, launching two new series: Hoken Kumikyoku Best MYWAY and Hoken Kumikyoku Best MYWAY Kisei Kanwa.

The key points of the product revision are as follows:

- New coverage introduced for mild cognitive impairment (MCI), a preliminary stage of dementia

- Minimum enrollment age for simplified issue insurance and other offerings lowered to three

In May 2025, we began offering the Severe Cancer Prepayment Rider, designed to ease the financial burden on patients with advanced cancer. This rider allows for the advance payment of death benefits if standard cancer treatments have been administered but determined to be ineffective, followed by specified palliative care.

HALFIT Service

Since April 2020, Daido Life has been offering customers up to three free sessions of the Neuro HALFIT® exercise program, which uses the wearable Hybrid Assistive Limb (HAL)® of CYBERDYNE, Inc. This service, delivered as an ancillary service of Kaigo Relief α, etc., is intended to help prevent disease advancement and increase the independence of people who require relatively light levels of care while insuring them against financial risk in the event long-term care is needed.

Diffusion-weighted Whole body Imaging with Background Body Signal

Since June 2025, Daido Life has been offering the Diffusion-weighted Whole body Imaging with Background body signal (DWIBS) Cost Coverage Service as an ancillary benefit exclusively for Advanced Cancer Coverage J Type. The Diffusion-weighted Whole body Imaging with Background body signal (DWIBS) is a cancer screening method that uses a high-performance MRI. Because it does not use radioactive substances, there is no risk of exposure, and compared with other cancer screenings, it offers shorter examination times and the physical burden on patients is reduced. Daido Life covers part of the cost of the examination to ease the financial burden on customers and help promote the early detection of cancer.

Insurance Protection for Precious Family Members

More pet owners recognize their pets as family members, and therefore interest in pet healthcare and its associated costs is growing. To respond to this situation, Pet & Family Insurance offers Genki Number One Smart, Genki Number One Slim and Genki Number One Best, products that compensate for a portion of the cost of treatments for pets at veterinary clinics due to illness or injury. These products address the needs for pet medical care costs and ensure that pet owners and their pets can receive veterinary treatment with peace of mind. In March 2024, we began offering Koredake Pet, a pet insurance product that allows customers to enroll through PayPay Insurance, which is part of the PayPay cashless payment platform.

Encourage all people to engage in social and economic activities

Asset formation is essential for active participation in social and economic life, allowing people to navigate everyday life and life events with peace of mind and to take on new challenges. In Japan, however, many people, regardless of age or gender, are uneasy about asset formation due to the worsening of the pension system and the rising costs of education, housing, and other essentials. By providing asset formation products tailored to customers’ attributes and diverse needs, the T&D Insurance Group encourages everyone to engage in social and economic activities.

Provision of Asset Formation Products Encouraging All People to Thrive Socially and Economically

Foreign currency-denominated whole life insurance Shogai Premium World 6

In September 2024, T&D Financial Life launched Shogai Premium World 6, a single-premium whole life insurance product that allows customers to leave money for family members while receiving money to use for themselves. This product integrates the features of the Shogai Premium Japan series of products offering the reassurance of yen-denominated coverage and the Shogai Premium World series of products utilizing overseas interest rates and foreign exchange rates, thereby addressing a broader range of customer needs in response to changing market conditions.

Variable insurance Hybrid Series

T&D Financial Life provides the Hybrid Series to support asset formation through self-provision in the era of 100-year lifespans by combining an investment trust with life insurance.

In June 2021, we launched Hybrid Asset Life, a yen-denominated single-premium variable whole life insurance product. We developed the product to help customers enjoy life to the fullest by drawing down assets in a planned manner while continuing to invest, with a focus on long-term diversified investment. The product also helps customers prepare themselves and their families for nursing care, dementia, and inheritance.

In April 2022, we launched Hybrid Tsumitate Life. This product is “asset formation insurance on a new axis that is closely attuned to the diversifying needs of the era of the 100-year life,” and it incorporates product schemes on a new axis based on the market research questionnaire conducted during its development.

This product can be used to manage funds through steady accumulation every month, while aiming for temporal diversification when forming assets, and it also adds spot increase amount and dollar-cost average plus rider functions, which enable customers to effectively utilize the surplus funds on hand, resulting in a product for which stabler and more efficient asset formation can be expected.

In March 2024, we launched Hybrid Omakase Life, a variable whole life insurance product. The product takes out existing variable whole life insurance and adds Omakase Investment that manages assets based on the individual customers’ desires and needs.

In April 2025, we launched Hybrid Anshin Life 2. This product inherits the features of Hybrid Asset Life, while additionally including a guaranteed minimum death benefit rider. Catering to people with longer lifespans, it specializes in asset succession and asset management functions. As part of this revision, we introduced the new Uketoru Course, which combines the existing mechanism for receiving excess benefits with death coverage. Customers can now choose from three options: the Uketoru Course above, the Nokosu Course, which secures investment results, and the Watasu Course, which allows customers to enjoy asset management while receiving annuity payments or making gifts to loved ones.

Individual annuities Fiveten World 4

In October 2024, T&D Financial Life launched Fiveten World 4. This product is the successor to Fiveten World 3, a single-premium individual annuity. It has been enhanced with a new course. Under the conventional Yen Currency Plan, we offered the Nursing Care and Dementia Coverage Course, which helps customers prepare for future nursing care and dementia through steady asset management. With this renewal, we established the new Annuity-Focused Course, which enables customers to further increase their future annuity principle. By providing this additional option, the product is now able to meet a broader range of customer needs.

Initiatives toward support for the resolution of the management issues of SMEs

In recent years, changes in the environment surrounding SMEs and the diversification of their needs has been progressing, including longer working lives for business owners due to medical technology advances and other changes, responses to inheritance and business succession, growing interest in social issues, in particular Health and Productivity Management and the SDGs, etc. Amid these changing circumstances, the T&D Insurance Group provides insurance coverage and services to protect the SMEs supporting Japan’s industries.

Provision of Protection That Widely Covers the Human Risks Faced by SMEs

Proposal of reasonable integrated coverage for the corporation and individuals (a full range of protection)

There are many cases in which SMEs rely on the reputation and technical capabilities of the business owners themselves for their viability. For this reason, continuation of the business sometimes becomes difficult in the case that the business owner dies or becomes unable to work due to a major illness or injury, etc. In preparation for this kind of situation, Daido Life calculates the funds necessary to protect the company and family (“standard coverage” and “living support funds”) to propose reasonable integrated coverage for the corporation and individuals (a full range of protection).

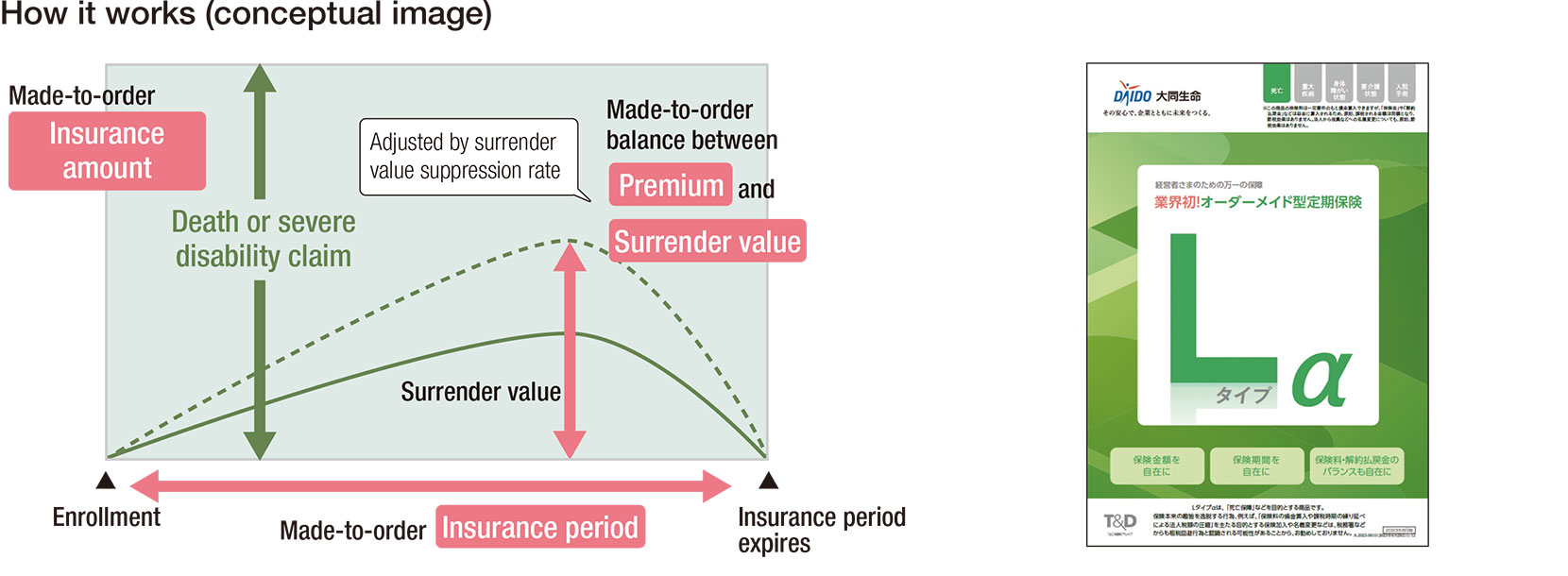

Made-to-order insurance to meet diverse coverage needs (L-type, J-type, and T-type products)

With the arrival of the era of the 100-year life and facing a serious lack of successors, a phenomenon including the aging of SME owners and the lengthening of their working careers is advancing. Meanwhile, structural changes in society and industry are presenting SMEs with more diverse management challenges and risks. These changes in the environment have brought about changes in the insurance needs of SMEs, in particular a growing need for products with coverage that can be flexibly configured according to business conditions and other factors. In response to this situation, we launched the industry’s first “made-to-order” insurance products to provide SME owners with long-term coverage against death, critical illness (cancer, acute myocardial infarction, and strokes), and severe physical disability. Specifically, in July 2019, we began offering L-type [non-participating age-specific maturity term life insurance (specified surrender value suppression rate type)], J-type [non-participating critical illness insurance (specified surrender value suppression rate type)], and T-type [non-participating disability protection insurance (physical disability certificate- linked/specified surrender value suppression rate type)]. These products cater to the diverse needs of customers by allowing them to freely configure not only the insurance amount and period, but even the balance between premium and surrender value.

![[Main product lineup] Protect corporations: Insurance to prepare for death “R-type”, “L-type α”. Insurance to prepare for critical illnesses “J-type”, “J-type α”, “Advanced Cancer Coverage J type”. Insurance to prepare for serious physical disability “T-type”, “T-type α”. Insurance to prepare for hospitalization and/or surgery “Lump-sum payment M-type”. Protect individuals: Insurance to prepare for loss of income “Shunyu Relief”. Insurance to prepare for nursing care costs “Kaigo Relief α”. Asset succession and inheritance preparation “Life Gift α”, “Life Gift”. Preparation for old age and asset formation “Individual annuity”, “Whole life insurance”.](/en/csr/effort/images/casestudy_25-14.png)

Initiatives Toward Support for the Resolution of the Management Issues of SMEs

Initiatives to Promote Health and Productivity Management*

Daido Life assists SMEs in implementing Health and Productivity Management. The aims are to contribute to creating a society where SMEs and their employees can be active and vigorous and to solving issues faced by Japan’s rapidly aging society.

*The Japanese term for “Health and Productivity Management” refers to a corporate management style of paying additional attention to employees’ health and strategically implementing policies aimed at employees’ health management and maintenance, and is a registered trademark of Non-Profit Organization Kenkokeiei.

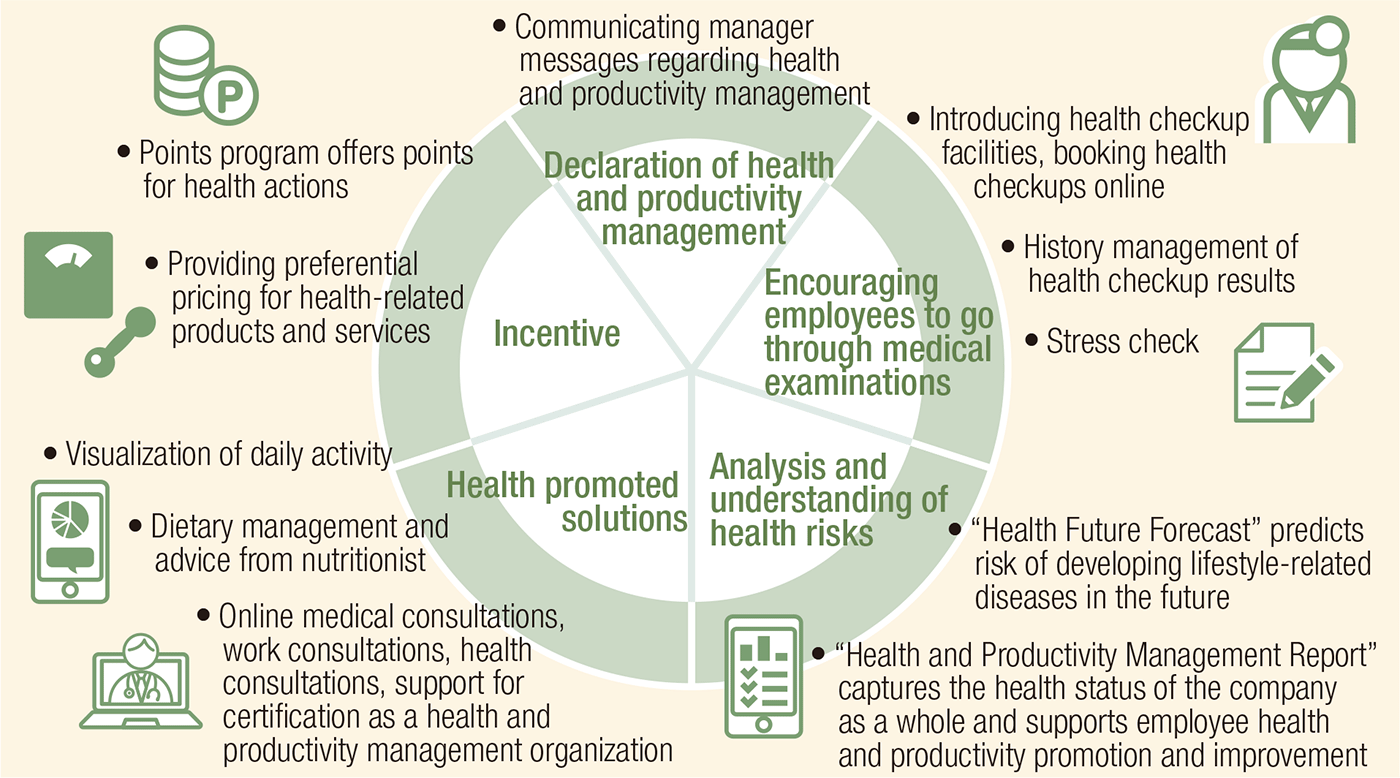

KENCO SUPPORT PROGRAM

Since April 2017, Daido Life has been providing the Daido Life KENCO SUPPORT PROGRAM in cooperation with a multitude of companies, in particular Value HR Co., Ltd., that possess specialized technology and know-how.

It is an app and web service targeted at SMEs that supports continuous implementation of the PDCA cycle necessary for Health and Productivity Management. This includes assisting companies in encouraging employees to go through health checkups, risk analysis of development of lifestyle disease, etc. for individual SME owners and employees, visualization of the company’s overall health status, and provision of health promotion solutions and incentives that promote continuous health improvement efforts.

Kaisha Minnade KENCO+

To prevent illness through health and productivity management, and prepare for unforeseen retirements, since January 2022 we have been offering a health-promoting insurance integrating the KENCO SUPPORT PROGRAM with protection. This product widely protects against a variety of risks such as death, severe disability, physical disability, critical illness, etc.; moreover, it has introduced a mechanism which discounts the basic policy insurance premiums the following year in the case that the customer’s “average number of steps per day is 8,000 steps or more every year.” We establish an “opportunity to start Health and Productivity Management” by getting all of the owners, executives, and employees of SMEs to enroll in insurance together.

Support for inheritance and business succession

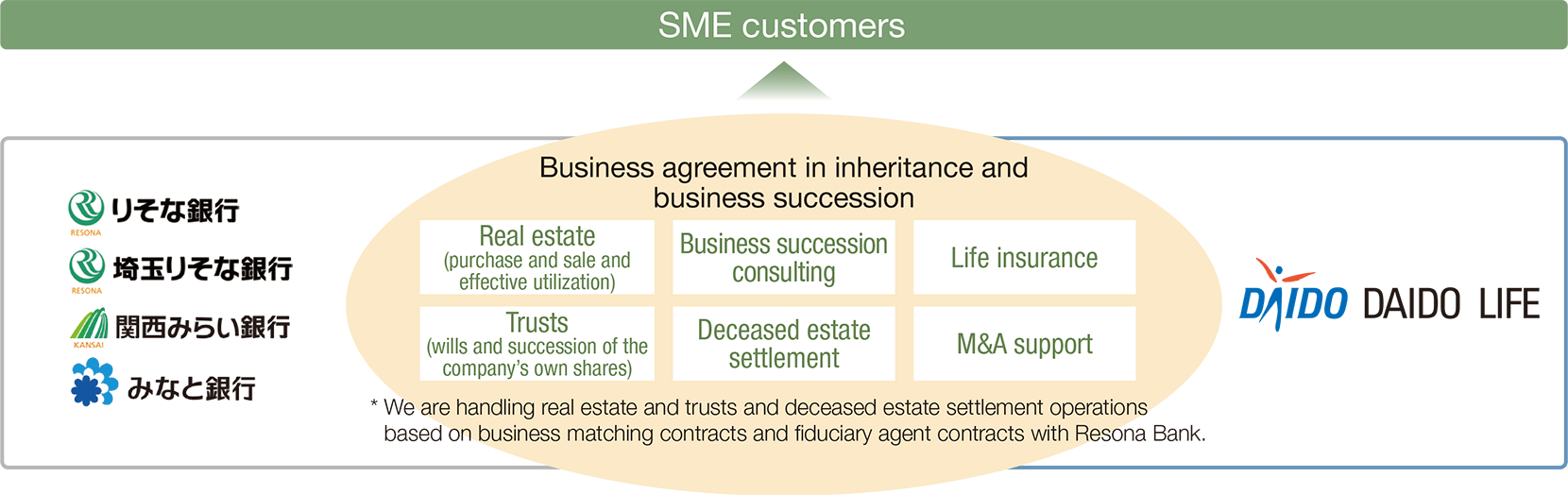

Recently, business owners have rapidly developed a growing interest in business succession. To accommodate business owners worried about whether they can smoothly hand on their business to a successor, since 2016 we have formed an organization of financial planning (FP) and inheritance consultants* who are specialists in inheritance and business succession, establishing a system to provide ongoing support to help customers solve their issues. Our FP and inheritance consultants provide advice about transferring a company’s own shares and risk management based on financial analysis, reflecting the results of estimated company share valuations. Additionally, through collaboration with partners, we are offering a wide range of consulting tailored to the issues customers face as experts in inheritance and business succession. These include M&A support services for thirdparty succession, Daido Management Academy as a successor development program, and the provision of solutions from the banking sector through our collaboration with the Resona Group.

*These are 1st-grade financial planning technicians (grade-1 FPs) or staff who have obtained CFP® qualifications, and who have been certified as inheritance and business succession experts after completing our dedicated training program

Commencement of Dodai?, a site for business owners sharing their views with each other

In March 2022, we commenced the web community Dodai? for the owners of SMEs to meet and tackle the resolution of social issues together. Through this service, Daido Life, which has supported SMEs through protection until now, will put into practice the idea of “creating the future together with SMEs” going forward.

Dodai? comprises four functions: “Consult” (a community where business owners can share ideals and worries with each other), “Learn” (introduction of real examples close to home for business owners), “Utilize” (provide centralized guidance about the various services available to support management), and “Connect” (provide company and business introductions and messaging functions). We are aiming for a service that can connect the owners of all SMEs throughout Japan and that can be used free of charge regardless of whether the companies have a policy with Daido Life.

The DAIDO Sustainability INITIATIVE

In recent years, interest in sustainability has been growing in society, including the 2050 Carbon Neutrality Declaration by the government, and initiatives for the SDGs (Sustainable Development Goals) are becoming large management issues for not only major companies but also SMEs.

Given the above changes in the environment, we are providing a program that helps our customers deepen their understanding of the SDGs. This program also encourages the practice of sustainability management by creating points of contact between companies with an interest in the SDGs and companies possessing technologies and services that contribute to the resolution of social issues and supporting the introduction of services and cooperation among companies.

![[The DAIDO Sustainability INITIATIVE] Customers: Company with an interest in the SDGs; Support company: Company possessing technologies and services. → Examples of specific initiatives for sustainability management](/en/csr/effort/images/casestudy_25-21.png)

Recruitment and training support services

Company possessing technologies and servicesWe offer “Free Consultation on Recruitment and Training of Human Resources (General Human Resources Consultation)” and various fee-based services in order to respond to a wide range of concerns regarding human resources, which is one of the management issues of SMEs.

![General Human Resources Consultation [Free] → Guidance about the range of services based on the personnel difficulties companies face: Support for the recruitment of high school graduates, Support for mid-career hiring, Support for the utilization of personnel with side jobs, part-time workers, and professionals, Provision of an in-house manual creation tool (video), Provision of e-learning courses.](/en/csr/effort/images/casestudy_25-22.png)

Promote the use of insurance and financial services for all (financial inclusion)

The T&D Insurance Group works to make insurance and services more accessible to individuals facing challenges in obtaining insurance. We will continue to promote this initiative to ensure that no one is left behind, allowing everyone to live healthier and improved lives.

Procedural System for Foreign Employees

In order to respond to the wishes of SME owners to care for all employees regardless of nationality, Daido Life has developed a procedural application system that enables applications in foreign languages for life insurance as welfare benefits and is intended for foreign employees (insured members) who have difficulty understanding Japanese. This system is used by many employees. (Explanatory materials in foreign languages, application form and sample form in foreign languages, videos explaining important matters in foreign languages, and telephone-based interpreter contact points, etc.)

| Available in eight languages | Chinese, Vietnamese, Filipino, Portuguese, Nepalese, Korean, English, and Spanish |

|---|---|

| Number of requests for use | a total of approximately 1,800* (from June 2019) (approximately 230 in FY2024) |

*There may be duplicate insured persons.

Providing Simplified Issue Insurance

Taiyo Life offers simplified issue insurance to provide coverage for customers with health concerns, allowing them to live their lives with peace of mind. In May 2023, we launched Simplified cancer diagnosis insurance and Simplified cancer treatment insurance, which can be applied for even by persons for whom it is generally difficult to apply for cancer coverage, such as individuals who had cancer in the past. Simplified cancer diagnosis insurance enables policyholders to receive a lump-sum payment upon being diagnosed with cancer, which helps cover the cost of treatment and living expenses. Simplified cancer treatment insurance allows them to receive benefits for each month that the insured undergoes certain kinds of treatment. This means that it is now possible to provide cancer coverage even to customers worried about their health.

In December 2024, we launched Hoken Kumikyoku Best MYWAY Kisei Kanwa. We address more diverse needs by lowering the minimum enrollment age for products with relaxed criteria.

Training Dementia Supporters, Promoting Participation in Universal Manners Certification Programs

Taiyo Life and T&D Financial Life conduct dementia supporter training courses annually. To enhance these courses, they work with the National Caravan Mate Liaison Council to develop and register In-house Caravan Mates.

| Number of Caravan Mates |

|---|

| 202 (as of March 2025) |

*The total number of Caravan Mates at Taiyo Life and T&D Financial Life

Elderly customers and customers with disabilities require special attention to address their unique circumstances. The Group’s three life insurance companies collaborate with the Japan Universal Manners Association to encourage employees at their head offices, branches, and sales offices nationwide to take courses to pass the Universal Manners Test. These companies assign staff with Universal Manners Certifications to their head office, branches, and sales offices to encourage all employees to communicate with customers from the perspective of individual customers and uplift them.

| Number of employees who have achieved Level 3 Universal Manners Certification |

|---|

| 13,545 (as of March 2025) |

*The total number of people certified at Taiyo Life, Daido Life, and T&D Financial Life

Promote the use of digital technology to meet diversifying customer needs

As lifestyles become increasingly diverse, customer needs are also becoming increasingly diverse. The T&D Insurance Group is enhancing customer convenience by using digital technology to provide services that allow customers to complete procedures anytime and anywhere.

Application Procedures Through the Mobile Terminal T-AI-Face

Since August 2018, Taiyo Life has transformed the way it conducts life insurance solicitation by introducing mobile devices equipped with advanced IT functions. The system features a “consulting and presentation” capability that allows sales representatives to listen to customers’ needs and propose optimal plans on the spot, while also achieving complete paperless processing from concluding the policy to receipt of payment. In August 2024, this was further evolved and transformed as T-AI-Face, a mobile terminal driven by AI technologies. A new way of developing proposals has been achieved, using AI to suggest the optimum protection plan, and doing so from anywhere, thanks to the use of digital technology.

AI Fund Prediction Service

In February 2024, T&D Financial Life has been offering the AI Fund Prediction Service. The service, the first of its kind in the industry, predicts unit price movement for separate accounts based on economic indicators and other data. Through the service, customers can view AI-driven predicted unit price change rates (versus the end of the previous month) for separate accounts being handled through the Hybrid Asset Life, Hybrid Anshin Life, and Hybrid Tsumitate Life products.

Sma-Hoken

Taiyo Life has created an Internet sales channel that enables customers to obtain insurance quotes and apply online at a convenient time and from a convenient location. Building on this, the company has launched Sma-Hoken, combining these options with the personalized in-person services we have cultivated over the years to develop a unique concept that allows it to provide online-only insurance with enhanced follow-up support. In addition to the Simplified cancer diagnosis insurance and Simplified cancer treatment insurance newly launched in 2023, we have started offering online-only Sma-Hoken for educational insurance and individual annuities.

Furthermore, in January 2021 we introduced Remote Application (non-face-to-face solicitation), which combines Sma-Hoken with sales-representative consultations and application procedure support. Through this Remote Application service, proposals to a greater number of customers, including customers requiring non-face-to-face services as well as distant customers for whom direct face-to-face applications are difficult, etc., are now possible, and these customers can now easily complete policy procedures from their own smartphones or computers anytime and anywhere.

Taiyo Life My Page

By using our dedicated customer service web portal Taiyo Life My Page, customers can complete procedures without having to visit the company, including address changes and other insurance maintenance procedures, use of loans and other funds, hospitalization benefits, etc., claim procedures, and more. Various procedures and benefit payments can be completed entirely online. In April 2022, we started providing Taiyo Life My Page service—the web insurance certificate and digital certificate—that enables not only policyholders but also insured members and registered family members to confirm policy details.

In May 2023, we launched a service that allows customers to access Taiyo Life My Page to create their own electronic barcode and use it to pay their second and subsequent insurance premiums at a convenience store. We also made it possible to use electronic barcodes for other payments, such as for first premium reserve payments in December 2023, and the repayment of policyholder loans in January 2024.

Furthermore, in September 2024, we introduced a function that enables the service center to share customers’ My Page screens and support procedures via My Page. The number of registered Taiyo Life My Page service members increased by approximately 360,000 from the end of fiscal 2023, reaching approximately 2.09 million by the end of fiscal 2024.

Priority Theme 2

Provide Workplace Environments that Enable Diverse Human Resources to Participate Actively

Basic Concept

We believe that in order to provide workplace environments that enable diverse people to participate actively, it is necessary to respect the personalities and diversity of all people, while realizing a healthy and safe work environment. At the T&D Insurance Group, we believe that our human resources, working side-by-side, are the most important driving force behind our business activities that we must highly value to fulfill the Group’s corporate philosophy. Since its foundation, the Group has promoted the nurturing of a corporate culture where a diverse workforce can feel job satisfaction and reach its potential, and has established the Basic Group Policy on Human Resources to clarify the Group’s basic approach to human resource management. Based on this policy, we are advancing a variety of initiatives.

Human Capital Management

The Group’s Approach to Human Resources

We believe that the human resources who work with us are the most important driving force behind our business activities to realize the T&D Insurance Group’s Corporate Philosophy* and have established the Basic Group Policy on Human Resources as the basic policy for human resources management in the Group.

Strengthening our core businesses within the Group growth strategy requires the strengths of each company with its own business model to be maintained and enhanced, and it is essential that each company continues its initiatives to develop human resources. Additionally, securing and developing highly specialized human resources is required to diversify and optimize our business portfolio outside of the life insurance business sector. In FY2025, we introduced the T&D Holdings Human Resource System with the goal of enhancing our ability to attract talent from the outside labor market and clarify career paths.

While society as a whole becomes more complex and the issues our Group must address become more difficult, it is important for the Group to expand its pool of human resources responsible for Group management from a mid- to long-term perspective to advance Group-wide integrated management. This is why we are pursuing the mobilization and collaboration of human resources across the Group.

Furthermore, it is essential that we establish an environment where all Group employees can thrive, going beyond human resources strategies aimed only at realizing the Group’s growth strategy, in order to achieve sustainable Group growth. The diverse human resources of each company should not be confined to their own business sectors. By working across the Group’s wide range of sectors and creating new value that cannot be achieved by a single company alone, we will lay the foundation for the Group’s sustainable growth.

To this end, the duty of the HR department is to maximize each employee’s potential, provide opportunities to proactively take on challenges, discover new things, and grow, and to support employees with a strong willingness to take on challenges so that they can do so with confidence.

We aim to be a Group where all employees can experience personal growth through their work, fully demonstrate their abilities, challenge their own potential, and gain a sense of pride and responsibility as members of the Group.

*“With our ‘Try & Discover’ motto for creating value, we aim to be a group that contributes to all people and societies.”

Initiatives to Provide Opportunities for Growth

The three life insurance companies conduct education and training, primarily through OJT (on-thejob training), group training, support for personal development, and reskilling/relearning. Each Group company encourages autonomous career development by each employee, by actively helping them to acquire qualifications and offering a diverse curriculum, including correspondence education, online courses, and e-learning, according to their educational plans. In addition, each Group company has introduced systems such as management by objectives and a 360-degree evaluation system, to ensure that employees clearly understand their roles and objectives and can experience confidence and satisfaction by achieving their objectives. These initiatives lead to accelerate employees’ career advancement and the development of human resources.

Diversity Promotion Initiatives

Employment of Persons with Disabilities

As of the end of March 2025, a total of 420 employees with disabilities, including 67 new recruits for fiscal 2024, worked at the three life insurance companies, which account for 2.57% of the total number of employees. We have put in place several measures designed to create a comfortable workplace for employees with disabilities. As a pre-hire initiative, we encourage the attendance of a placement support worker at job interviews, so that job candidates can go through the screening process without worry. We also hold workplace tours for candidates to prevent assignment mismatches. After hiring, we strive to provide company-wide support, through measures such as preparing a comfortable working environment by introducing specialized computers and other equipment, and taking commuting routes into consideration. In addition, job coaches who specialize in support for employees with disabilities are dispatched to the company, and a placement support worker holds interviews together with the employee and his or her supervisor, and offers advice. We will continue working to create a workplace environment that encourages and supports persons with disabilities in working comfortably, and to expand employment opportunities for persons with various disabilities.

| FY2022 | FY2023 | FY2024 ★ | |

|---|---|---|---|

| Employment rate of people with disabilities | 2.48% | 2.58% | 2.57% |

* The organizations covered by the calculation of the employment rate of people with disabilities are Taiyo Life, Daido Life, and T&D Financial Life.

* The employment rate of people with disabilities is calculated based on the Act to Facilitate the Employment of Persons with Disabilities, etc.

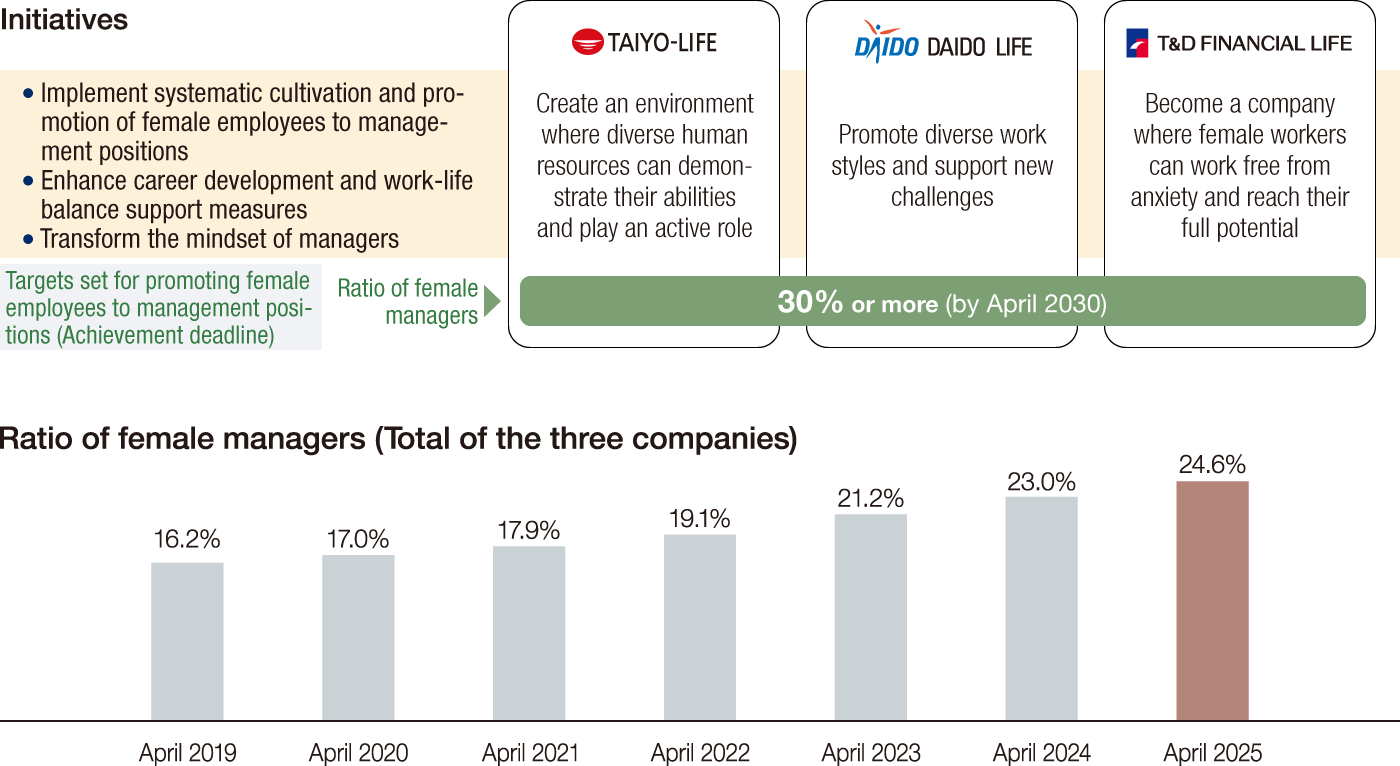

Initiatives to Support Active Participation of Women

The T&D Insurance Group has accelerated efforts to create a corporate culture where a diverse workforce can feel job satisfaction and reach their potential. The Group recognizes that enabling women to further reach their potential is an important driver of sustainable growth in corporate value, and that their active participation is a crucial management priority for the Group. With this in mind, the Group’s three life insurance companies are working to revise their respective personnel and compensation systems, as well as introducing various support systems to enhance employees’ work-life balance, including balancing work with childcare and nursing care. In addition, by fostering a Group-wide collaboration to reduce total working hours and encourage male employees to take childcare leave, we are making an effort to create rewarding workplace environments where everyone is motivated to play an active role. To steadily advance these initiatives and promote the active participation of female employees, the Group’s three life insurance companies have each set targets for promoting female employees to management positions (25% by 2027 and 30% by 2030), and are working to systematically nurture female employees for promotion to management positions.

Targets for promoting the active participation of women at the three life insurance companies

The Group’s three life insurance companies have disclosed targets for appointing female employees to management positions as part of their efforts to promote the active participation of women. Through the steady implementation of these initiatives, the ratio of female managers has been increasing each year. Since the gender wage gap is largely attributable to the difference in the ratios of men and women in management positions, increasing the ratio of female managers also contributes to narrowing this gap.

* The figure including junior managers is calculated with a view toward the systematic and gradual development of female management executives.

LGBTQ+friendly

Welcomed by the Group

Underpinned by its basic approach to respecting human rights expressed in the T&D Insurance Group’s Human Rights Policy, the Group strives to develop a workplace environment in which each and every employee can fully realize their own potential. From the viewpoint of diversity, each Group company is addressing LGBTQ+ (sexual minorities) issues by running training sessions.

Daido Life treats same-sex partners as spouses under its leave and benefit program and has also established an “LGBTQ Consultation Desk” that gives advice to and deals with a wide range of inquiries from sexual minority employees.

Customer-oriented

The T&D Insurance Group’s three life insurance companies have also started to allow policyholders to designate same-sex partners as beneficiaries of insurance benefits, just like for a spouse, by submitting documents showing that the two people are in a partnership, such as a partnership certificate issued by a local government.

Daido Life is expanding the areas in which same-sex partners living together are accorded the same treatment as spouses, including procedures for new policies, payments, and policy changes.

| Response | Date |

|---|---|

| Possible to designate as beneficiary for death benefits | November 2015 |

| Possible to designate as registered family in the Family Registration Program | |

| Possible to sign on behalf of a partner for procedures such as new policies, payments when the partner is unable to do so for him/herself | December 2016 |

| Possible to designate as a preregistered proxy | April 2018 |

Worker-friendly Work Environment

Efforts for Occupational Health and Safety

The T&D Insurance Group strives to ensure a healthy and safe workplace environment based on the Group Sustainability Charter established by resolution of the Board of Directors. As part of this effort, each Group company has formulated regulations and policies concerning Health and Safety that clarify legal obligations and stipulate matters related to maintaining and promoting employee health. We are promoting various initiatives such as the following.

●Workplace Systems Supporting Health and Safety

The T&D Insurance Group has a clinic at its head office, and promotes the health of its employees through periodic health committee meetings at each branch office in collaboration with industry physicians and the labor union. The Group companies also take care of the mental health of their employees and, by contracting external physicians, provide a system for consultation and medical service that employees can utilize free from anxiety.

●Strengthening Mental Health Measures Using Stress Checks

All employees at T&D Insurance Group companies are invited to undergo a stress check as part of the program’s goal of preventing mental health disorders. The Group encourages self-care among its employees, and has also put in place a system for employees under particularly high stress to receive in-person advice from a physician, and when necessary, to introduce such employees to specialists the Group has contracted with on a part-time basis. Each company also conducts group analysis, which is beneficial in improving the workplace environment.

●Initiatives to Reduce Total Working Hours

Our Group promotes measures to curb long working hours and build efficient work systems. These include reducing total working hours and overtime, promoting the use of paid leave,Implementation of No Overtime Days and Leave Work Early Days, implementation of automatic PC shutdowns, planned annual leave. These efforts aim to enhance employee work-life balance and productivity.

●Employee Health Promotion

To address key health risks among employees, our Group implements diverse health promotion measures across companies. These include providing disease prevention screenings and health programs, encouraging early participation in regular health checkups, and establishing health consultation services. These efforts aim to maintain employees' physical and mental health and improve their lifestyle habits.

Work-Life Balance Initiatives

The T&D Insurance Group companies are strengthening various initiatives to help employees balance work with family responsibilities, such as their childbirth, childcare, and nursing care responsibilities, so that they can make full use of their skills and increase their performance at work, while fulfilling their responsibilities at home, such as housework, childcare, and nursing care. In addition to various efforts to reduce total working hours and encourage its employees to take paid leave, the Group is also promoting work style reforms by introducing a flextime system, remote work, and satellite offices, thereby enabling employees to choose highly productive ways of working regardless of time or location. Working as one, the Group is committed to realizing a healthy work-life balance.

Work-life balance support

Childbirth and childcare

The T&D Insurance Group companies have established systems for leave and shorter working hours related to childbirth and childcare that go above and beyond what is required by law.

| System | Overview (availability varies by Group company) |

|---|---|

| Maternity leave | Employees may take maternity leave from six weeks before the birth of their child to eight weeks after. |

| Childcare leave | Employees may take childcare leave until their child reaches the age of three (statutory limit: up to the age of two). *The handling of childcare leave for sales representatives varies by company. |

| Shorter working hours for childbirth and childcare |

Employees may use this system up to twice per child until the child graduates from elementary school. *In some Group companies, pregnant employees and those raising children up to the end of elementary school can shorten their daily work hours to four, five, or six hours. |

| Childcare participation leave |

Employees may take five to twenty days of leave per eligible child to participate in childcare activities. *In some Group companies, this leave can be divided and taken up to four times. |

| Hospital leave | Pregnant employees and employees within one year of the birth of their child may take a specified number of days of leave to receive health guidance and medical checkups. *In some Group companies, the leave can be taken in 10-minute increments. |

| Company-led childcare services |

Employees with children below elementary school age may use company-designated childcare slots through partnership agreements for the shared use of company-led childcare facilities. |

| Staggered working hours |

Pregnant employees may adjust their start time by up to 30 minutes. |

| Restrictions on overtime work |

Pregnant employees are not required to work more than eight hours per day. Employees with children below elementary school age are not required to work beyond their regular working hours or their chosen amount of overtime. |

Family Nursing Care Systems

The T&D Insurance Group companies have introduced family nursing care leave systems with durations exceeding legal requirements, enabling employees to care for injured or ill children and other family members in need of care or support.

| System | Overview (availability varies by Group company) |

|---|---|

| Nursing care leave | Employees may take up to one to three years of leave per family member in need of care (statutory limit: 93 days). *In some Group companies, employees may take this leave up to three times per eligible family member who has been certified as requiring long-term care (level 1 or higher). |

| Nursing care days off | Employees may take five to thirty days of nursing care leave per year. *In some Group companies, the leave can be taken in 10-minute increments. |

| Shorter working hours system | Employees may use the shorter working hours system to provide nursing care for family members. |

| Child nursing and related leave | Employees raising children up to the sixth grade of elementary school may take five to ten days of leave per year to care for a sick or injured child, accompany them for vaccinations or medical checkups, look after them during school closures, or attend school entrance or graduation ceremonies. *In some Group companies, this leave can be taken in 10-minute increments and is fully paid. |

| Restrictions on overtime work | Employees providing nursing care for family members are not required to work beyond their regular working hours or their chosen amount of overtime. |

| Shortened working hours | Employees providing nursing care for family members may shorten their working hours for a period of up to three years. |

Career continuity support systems

The T&D Insurance Group companies have established systems to support employees in balancing work with medical treatment, facilitating their return to work after leave, and continuing their careers when their spouses are transferred.

| System | Overview (availability varies by Group company) |

|---|---|

| Balancing work and medical treatment | Employees may use hospital leave (for cancer treatment and other medical needs), as well as systems for staggered working hours (up to 30 minutes), shorter working hours, and reduced working days. |

| Wellness leave | Employees may take up to three days per month and twelve days per year when work is difficult due to menstruation or PMS, for medical visits or treatment related to infertility or menopausal symptoms, to undergo follow-up medical examinations or comprehensive health checkups, or for gender-affirming surgery. |

| Smooth return to work | Administrative personnel are provided with company laptops to access the latest company information during childcare leave, and they have regular meetings with their supervisors while on leave. |

| Family transfer system | When a spouse is transferred, administrative personnel may request reassignment to a workplace within commuting distance from their new residence. |

| Career support | Opportunities are provided for working mothers to exchange information and share experiences about careers and childcare beyond company boundaries. |

| Change from national to regional positions |

Administrative personnel in national positions involving transfers may temporarily switch to regional positions when transfers become difficult due to childcare, nursing care, medical treatment, or nursing care for family members. |

| Birthday leave | All employees are granted birthday leave for their children until they enter elementary school. |

| My Area system | Employees may choose their preferred work location. |

Key Performance Indicator

The Group's three life insurance companies have set the ration of female managers as their Key Performance Indicator and are taking action to achieve the target.

Ratio of female managers (target and result)

| Taiyo Life | Daido Life | T&D Financial Life | |

|---|---|---|---|

| Target | 30% or more (by April 2030) | ||

| 2014 | 19.1% | 8.5% | 8.2% |

| 2015 | 19.0% | 10.4% | 9.1% |

| 2016 | 19.6% | 12.3% | 9.6% |

| 2017 | 19.1% | 13.0% | 11.0% |

| 2018 | 19.5% | 14.1% | 11.5% |

| 2019 | 19.4% | 14.8% | 13.0% |

| 2020 | 20.4% | 16.6% | 12.5% |

| 2021 | 20.4% | 17.5% | 14.5% |

| 2022 | 20.2% | 19.0% | 16.7% |

| 2023 | 21.2% | 22.8% | 15.6% |

| 2024 | 22.5% | 24.7% | 12.1% |

| 2025 | 24.2% | 25.6% | 12.5% |

* The results of each year are as of April. Rounded to the first decimal place.

Priority Theme 3

Contribute to Global Environment Conservation and Climate Change Mitigation and Adaptation

Basic Concept

The Paris Agreement adopted in December 2015 set holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels as long-term global goals. Achieving net zero emissions and carbon neutrality by 2050 is required to realize this target. While global climate change is a risk that threatens the continuity of the Group’s business activities, the Group believes that it is an opportunity to undertake new activities. With this perspective, the Group is intensifying its efforts to achieve net zero CO2 emissions throughout its operations, including its asset management operations.

Moreover, in December 2022, the Kunming-Montreal Global Biodiversity Framework was adopted, setting out new global goals and targets for biodiversity. The mission of the framework is to take urgent action to halt and reverse biodiversity loss to put nature on a path to recovery by 2030. In light of the increasing importance of disclosing information about natural capital, the Group registered as a TNFD Adopter in September 2024. It is promoting investment, lending, and engagement in alignment with various social issues and themes, including biodiversity.

To protect the global environment, transition to a low-carbon or decarbonized society and adapt to climate change, it will be necessary to transform the industrial structure on a large scale and modify our behavioral patterns. The T&D Insurance Group also remains cognizant of the fact that we must do our part as a member of society. The T&D Insurance Group formulated the T&D Insurance Group Environmental Policy* to clarify the Group’s stance on the environment in its business activities and the T&D Insurance Group ESG Investment Policy* to outline its approach to ESG investment in its asset management activities. The Policy is to carry out business activities with full awareness of the importance of environmental concerns, and to ensure that executives and employees understand that they must act in consideration of the protection of the global environment. The Group will achieve sustainable growth along with society while fulfilling the public mission of life insurance and other businesses, and undertaking its corporate social responsibilities.

* For more information on the T&D Insurance Group Environmental Policy and the T&D Insurance Group ESG Investment Policy, please see our website.

Disclosure of Climate-related Financial Information Based on the TCFD Recommendations

The Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB), formulated its recommendations for clarified, comparable, and consistent information disclosure regarding the risks and opportunities posed by climate change. These recommendations were announced in June 2017. Climate change is an issue to be addressed on a global scale. The effects of climate change have significant impacts on the lives of people, through changes in economic behaviors and society worldwide. The T&D Insurance Group has expressed its support for the TCFD recommendations, and is actively committed to disclosing climate-related financial information in an easy-to-understand manner.

Initiatives to Reduce the Environmental Impact

Environmental Initiatives

Reduction of CO2 Emissions

Over 90% of the Group’s CO2 emissions (Scope 1 + 2) arise from electricity use. For that reason, we are endeavoring to reduce CO2 emissions by setting targets for reducing electricity consumption in order to curb energy usage and advancing the introduction of renewable energy.

Power-saving Efforts

Each year the T&D Insurance Group participates in a “Cool Biz” campaign from May to October (setting thermostats of air conditioners at 28°C) and a “Warm Biz” campaign from November to March (setting a room temperature at 20°C). In addition, as a power-saving measure to prevent global warming, the Group turns off or reduces the lighting in offices, meeting rooms, hallways and other areas when they are not in use.

“Lights Down” Campaign

As an initiative to raise the environmental awareness of each of the Group’s executives and employees, the T&D Insurance Group has been conducting a campaign in which it calls for a simultaneous switch-off of all the lights in offices twice a year. In fiscal 2024, this initiative was conducted in July and December. Going forward, we will continue our initiative of a simultaneous switch-off of all the lights which can contribute to the prevention of global warming.

Forest Conservation Activities